Ratio Analysis

Ratio analysis is a process of carefully studying the relationships between different data sets inside a company’s financial statements with the help of arithmetic ratios.

It helps in a meaningful understanding of a firm’s performance and its financial position. All major financial statements can act as an input to the ratio analysis, ratios of one set of data or a combination are examined with respect to similar data or combination.

For example – Current Ratio, It can be computed as Current Assets/Current Liabilities

Current Assets – Can be derived from the assets side of a company’s balance sheet

Current Liabilities – Can be sought from the liability side of a company’s balance sheet

Current Assets/Current Liabilities will show the relationship between a company’s current assets and current liabilities. This ratio will help us find out the value of current assets the company holds for every unit of current liability. Accounting ratios are used to do a trend, cross-sectional & various other analysis to ascertain how the company is doing.

Types of Ratios

- Liquidity Ratios – These ratios help demonstrate a company’s ability to repay its short-term financial obligations. Higher the liquidity ratio easier it is for the company to cover its short-term debts. E.g. Current Ratio, Liquid/Quick Ratio etc.

- Solvency Ratios – These ratios show the long-term financial position of a business, it helps to measure a company’s ability to meet its long-term debt and similar obligations. E.g. Interest Coverage Ratio, Debt to Equity Ratio, Proprietary Ratio etc.

- Profitability Ratios – As the name suggests these ratios help to determine the profitability of a firm. E.g. Gross Profit Ratio, Operating Ratio, Return on Investment, Net Profit Ratio etc.

- Activity or Turnover Ratios – These ratios show how efficiently a company is using its resources & to identify if there is under or overutilization of resources. E.g. Debtor’s Turnover Ratio, Working Capital Turnover Ratio, Inventory Turnover Ratio etc.

Related Topic – What is Undercapitalization?

Types of Analysis

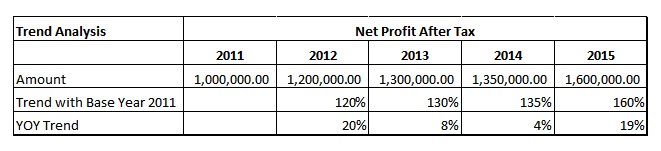

- Trend Analysis – In this type of analysis ratios of business are compared with its past records to find out tendencies of growth, stagnation or decline.

Data for anyone period such as a year, month etc. are used as base and data for remaining periods is then worked around it to calculate percentage change subsequently.

In the above example 2 different types of trending can be seen, one with the base year 2011 & year on year trending comparing change from previous years. With base year 2011 Net profit after tax in 2012, 2013, 2014 & 2015 is 120%, 130%, 135% & 160% respectively.

With YOY trending in 2012 NPAT grew 20% with that of 2011, In 2013 in grew 8% with that of 2012 & so on. To explain we used simple numbers, similar trending can be done with ratios & shall be termed as ratio analysis.

- Cross-Sectional Study – This is done by analyzing a company’s financial data with that of Industry average or Industry peers i.e. companies of similar size etc.

A comparison is done between competitors or among the industry in which the company operates for e.g. an FMCG company will be compared with the average of entire FMCG sector’s average or with that of another similarly sized competitor.

Short Quiz for Self-Evaluation

>Read What is Overcapitalization?