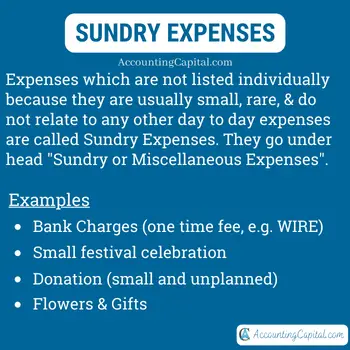

Sundry Expenses

The word “Sundry” is used for items which are irregular and insignificant to be listed individually. Sundry expenses are costs incurred during business operations that are not listed separately because they are usually small, rare, and do not relate to other general expenditures.

They are comparatively small, miscellaneous in nature & can not be classified under a specific day-to-day expense ledger.

They may also be referred to as “Miscellaneous Expenses”. They can be related to a particular area within a business such as sundry office expenses, sundry retail expenses, etc.

Examples of Sundry Expenses

As mentioned above these types of expenses do not usually have a separate ledger account however they can be grouped together and clubbed together as sundry expenses. There are no hard and fast rules for categorizing expenses as sundries but they should definitely not include any regular payments or capital expenses.

Examples may include expenses related to bank service charges (not regular), gifts & flowers, festival celebrations, donations, etc.

Related Topic – What is a Journal?

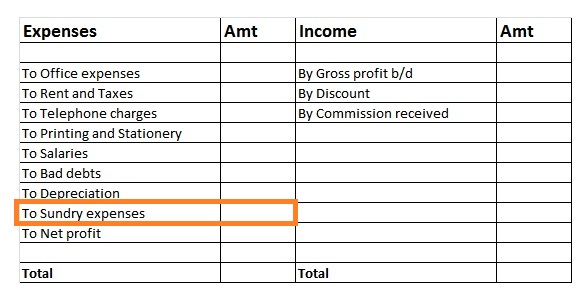

Treatment in Financial Statements

Sundry expenses are shown on the expenses side (left) of a profit and loss account (Income statement). Size, industry practice & nature of an expense plays an important role to determine whether it should be included in sundries or be given a separate ledger account.

Back in the days of manual bookkeeping, there was a greater need for such classifications since having a particular ledger account made for every little expense would not feasible. Now with ERPs and modern computer systems, the need to reclass dozens of small expenses as sundry expenses has been greatly reduced.

Sundry Expenses Vs General Expenses

| Basis | Sundry Expenses | General Expenses |

|---|---|---|

| Definition | One-time or random expenses that cannot be classified under another expense category are called sundry expenses. | They are general, regular, day-to-day, and necessary expenses that are grouped under a general category. |

| Frequency | There is no fixed interval for sundry expenses. Either they are one-time or intermittent. | General expenses occur regularly. |

| Size | It is typical for such expenses to be small or to be made up of several small expenses. | They are usually larger (in comparison), regular, and significant for core business operations. |

| Examples | Once in a while bank transfer charges (WIRE), Donations, Flowers & Gifts, etc. | Salaries, rent expense, purchase of raw material, electricity expense, depreciation, etc. |

Related Topic – Type of account and normal balance of a petty cash book

Journal Entry for Sundry Expenses

| Sundry Expense A/C | Debit |

| To Cash/Bank A/C | Credit |

(Being payment of sundry expenses made by cash/bank)

Sundry Expense Account – It is an expense for the business therefore debit the increase in expense.

Cash/Bank Account – Credit the decrease in assets.

Related Topic – Is an expense debit or credit?

Short Quiz for Self-Evaluation

Revision & Highlights Short Video

Highly Recommended!!

Do not miss our 1-minute revision video. This will help you quickly revise and memorize the topic forever. Try it :)

>Related Long Quiz for Practice Quiz 38 – Sundry Expenses

>Read Prepaid Expenses