Discount Allowed

Discounts are very common in today’s business world, they are generally provided in lieu of some consideration which can range from timely payments to market competition. While posting a journal entry for discount allowed “Discount Allowed Account” is debited.

Discount allowed acts as an additional expense for the business and it is shown on the debit side of a profit and loss account. Trade discount is not shown in the main financial statements, however, cash discount and other types of discounts are supposed to be recorded in the books of accounts.

In case of a transaction where both trade discount and cash discount are allowed, the trade discount is allowed first and then the cash discount is processed.

Related Topic – Journal Entry for Discount Received

Journal Entry for Discount Allowed

It is journalized and the balances are pushed to their respective ledger accounts.

| Cash A/C | Debit | Real A/C | Dr. What comes in |

| Discount Allowed A/C | Debit | Nominal A/C | Dr. All expenses |

| To Debtor’s A/C | Credit | Personal A/C | Cr. The giver |

Discount allowed ↑ increases the expense for a seller, on the other hand, it ↓ reduces the actual amount to be received from sales.

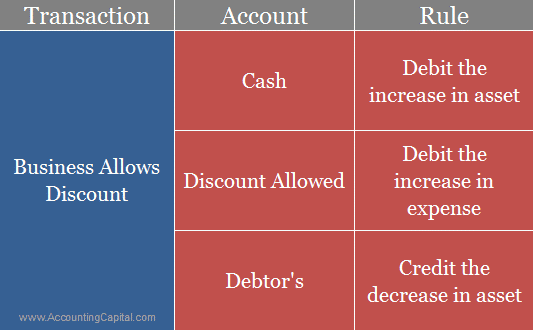

Simplifying the entry with the help of modern rules of accounting

Discount allowed by a seller is discount received for the buyer. The following examples explain the use of journal entry for discount allowed in real-world events.

Examples – Journal Entry for Discount Allowed

- Cash received for goods sold to Unreal Co. worth 50,000 along with a 10% discount. (Discount allowed in the regular course of business)

| Cash A/C | 45,000 |

| Discount Allowed A/C | 5,000 |

| To Unreal Co. A/C | 50,000 |

- Received 5,000 from Unreal Co. in full and final settlement of their account worth 10,000. (Discount allowed to settle an overdue payment)

| Cash A/C | 5,000 |

| Discount Allowed A/C | 5,000 |

| To Unreal Co. A/C | 10,000 |

Short Quiz for Self-Evaluation

>Read Journal entry for goods given as charity or free samples