Discount Received

Discounts are common in both B2B and B2C transactions to push both credit and cash sales, they are usually given in lieu of some consideration which can be prompt payments, trade practices, recoveries, etc. While posting a journal entry for discount received “Discount Received Account” is credited.

Discount received acts as a gain for the business and is shown on the credit side of a profit and loss account. Trade discount is not shown in the main financial statements, however cash discount and other types of discounts are shown in books of accounts.

Journal entry for discount received is essentially booked with the help of a compound journal entry.

Related Topic – Journal Entry for Discount Allowed

Journal Entry for Discount Received

After it is journalized the balances are pushed to their respective ledger accounts.

| Creditor’s A/C | Debit | Personal A/C | Dr. The receiver |

| To Cash A/C | Credit | Real A/C | Cr. What goes out |

| To Discount Received A/C | Credit | Nominal A/C | Cr. All incomes & gains |

Discount received ↑ increases the income for a buyer, on the other hand, it also ↓ decreases the actual amount to be paid for purchases.

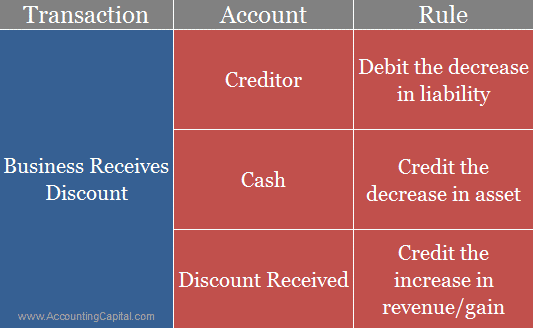

Simplifying the transaction with the help of modern rules of accounting

Discount received by a buyer is discount allowed in the books of the seller. Following examples explain the use of journal entry for discount received in the real-world scenarios.

Examples – Accounting for Discount Received

- Payment made to Unreal Co. in cash for goods purchased worth 5,000 at 10% discount. (Discount received in the regular course of business)

| Unreal Co. A/C | 5,000 |

| To Cash A/C | 4,500 |

| To Discount Received A/C | 5,00 |

- Paid 2,000 to Unreal Co. in cash for full and final settlement of their account worth 10,000. (Discount received to settle an overdue payment)

| Unreal Co. A/C | 10,000 |

| To Cash A/C | 2,000 |

| To Discount Received | 8,000 |

Short Quiz for Self-Evaluation

>Read Deferred Revenue Expenditure