Journal Entry for Income Received in Advance

Also known as unearned income, it is income which is received in advance, however, the related benefits are yet to be provided. It belongs to a future accounting period and is still to be earned. Journal entry for income received in advance recognizes the accounting rule of “Credit the increase in liability”.

Examples of income received in advance – Commission received in advance, rent received in advance, etc. Such advances received are treated as a liability for the business.

Journal entry for income received in advance is;

| Income A/C | Debit | Debit the decrease in income |

| To Income Received in Advance A/C | Credit | Credit the increase in liability |

As per accrual-based accounting unearned income must be recorded in the books of finance irrespective of when the related goods/services are provided.

Related Topic – What is the Journal entry for Accrued Income?

Simplifying with an Example

Question – On December 20th 2019 Company-A receives 1,20,000 (10,000 x 12 months) as rent in cash which belongs to the following year (Jan 2020 to December 2020).

Show all related rent entries including journal entry for income received in advance on these dates;

- December 20th 2019 (Same Day)

- December 31st 2019 (End of the period adjustment)

- January 1st 2020 to December 31st 2020 (Beginning of each month next year)

1. December 20th 2019 – (Money received for rent to be collected next year)

| Cash A/c | 1,20,000 |

| To Rent Received A/c | 1,20,000 |

2. December 31st 2019 – (Rent receivable next year adjusted with rent received in advance account)

| Rent Received A/c | 1,20,000 |

| To Rent Received in Advance A/c | 1,20,000 |

3. January 1st 2020 to December 1st 2020 – (Income matched to each period)

| Rent Received in Advance A/c | 10,000 |

| To Rent Received A/c | 10,000 |

All 12 months from Jan’20 to Dec’20 will be consumed in each period against the rent received in advance account to reduce the advance account to zero by end of the year.

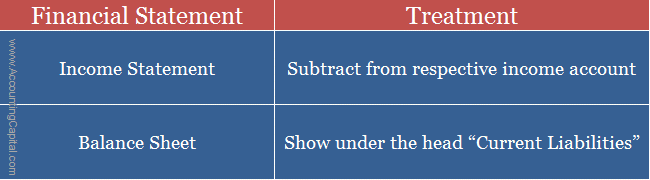

Treatment of Income Received in Advance in the Financial Statements

After posting the journal entry for income received in advance a business records it the final accounts as follows;

- Reduces it from the concerned income head on the credit side of the income statement.

- Shows it as a liability in the current balance sheet under the head “Current Liabilities“.

Example – Journal Entry for Rent Received in Advance

Let’s assume that in the month of March 10,000 are received in advance for rent, the rent actually belongs to the month of April.

Journal entry to record this in the current accounting period is;

| Rent Received A/c | 10,000 |

| To Rent Received in Advance A/c | 10,000 |

(Assuming cash was debited and rent received was credited at the time of actual receipt)

Example – Journal Entry for Commission Received in Advance

Total of 2000 was received as commission earned in the current accounting year. Post the journal entry for income received in advance (commission earned) to include the impact of this activity.

| Commission Received A/c | 2,000 |

| To Commission Received in Advance A/c | 2,000 |

(Assuming cash was debited and commission received was credited at the time of actual receipt)

Short Quiz for Self-Evaluation

>Related Long Quiz for Practice Quiz 31 – Income received in Advance

>Read Top Accounting and Finance Interview Questions