Rectification Entries, With Examples

When an error is committed in the books of accounts the same should be corrected to show true numbers in financial statements. If the error is immediately identified it may be fixed by striking out the wrong entry and replacing it with a correct one. However, if the error is identified at a later stage, the correction should be made by passing a suitable journal entry, such entries used to fix an accounting error are called rectification entries.

Nowadays with software packages if a journal entry has been posted to the ledger it usually requires rectification entry, however, if it is still at a preliminary stage of validation then it may be corrected without the need of an additional entry. Errors are required to be rectified before finalization of books of account.

Stated below are types of errors and their respective rectification entries illustrated with examples;

Rectification Entry for Errors of Omission

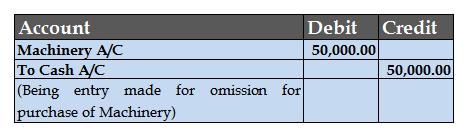

Omission made for the purchase of Machinery worth 50,000, the same can be rectified by passing a simple double-entry that can record debit and credit aspects of this transaction. The following entry shall be passed:

(Rectification of missing entry for purchase of machinery)

After the above rectification cash can be posted in the cash book and cash account. Office equipment can be entered into office equipment ledger account which means the error has now been corrected.

Related Article – What are closing entries?

Rectification Entry for Errors of Commission

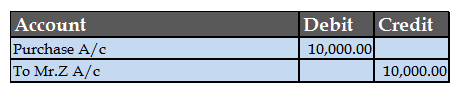

Purchase of goods from Mr Z aggregating to 10,000 erroneously entered in the ledger of Mr.B. To rectify this error, we will have to reverse Mr B’s account and have to credit Mr Z’s account with the amount of goods purchased.

Correct Entry which should have been passed

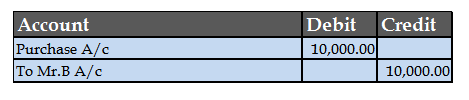

Wrong Entry

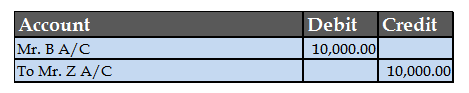

Rectification Entry

(Rectification of wrongly posted purchases to Mr B’s A/C)

This is a classic case of a reclass entry.

Related Article – Why is closing stock not shown in trial balance?

Rectification Entry for Errors of Principle

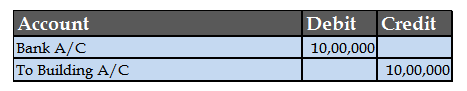

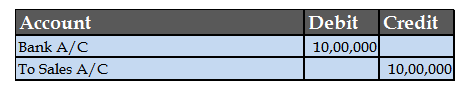

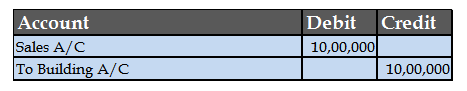

Sale of Building for 10,00,000 entered into Sales Account.

A building is a fixed asset hence it should be entered in the building account. Therefore, we will have to rectify the sales account by debiting it and crediting the same amount to the building account.

Correct Entry which should have been passed

Wrong Entry

Rectification Entry

(Rectification of entry passed in Sales account by mistake for Sale of Building)

Related Article – What is a bank reconciliation statement?

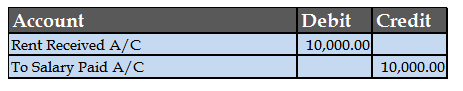

Rectification Entry for Errors of Compensation

Rent income is overstated by 10,000 and salary expense is overstated by 10,000.

Since rent income has a credit balance and salary expense has a debit balance, the overstatement of rent income balance will offset the overstatement of the salary account balance. There will not be any effect on the trial balance. Rectification of the same shall be done by reducing Rent Income and Salary Expense.

(Being rectification of entry passed for reversal of Income over expense)

Short Quiz for Self-Evaluation

> Read What is Suspense Account?