Acid Test Ratio

Acid Test Ratio/Liquid Ratio/Quick Ratio is a measure of a company’s immediate short-term liquidity. It is calculated by dividing liquid assets by current liabilities. Liquid assets can be termed as those assets which can almost immediately be converted to cash or an equivalent.

Unlike the current ratio, this doesn’t take into account inventories and prepaid expenses since both of them can’t be seen as liquid assets. Since the quick ratio is a better indicator of liquidity or in other words short-term solvency of a business it becomes a crucial ratio to be examined by Banks and NBFCs to check a firm’s short-term debt paying capacity.

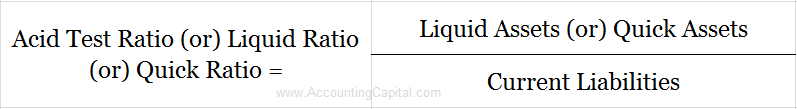

Formula to Calculate Acid Test Ratio/Quick Ratio/Liquid Ratio

Liquid or Quick Assets = (Total Current Assets – Inventory – Prepaid Expenses)

Acid Test Ratio = (Total Current Assets – Inventory – Prepaid Expenses)/Current Liabilities

Example of Acid Test Ratio

Unreal corporation has submitted the below information regarding their current assets and current liabilities, calculate the Acid Test Ratio

| Current Assets | Amt | Current Liabilities | Amt |

| Cash & Equivalents | 20,000 | Outstanding Expenses | 15,000 |

| Marketable Securities | 150,000 | Provision for Expenses | 10,000 |

| Inventories | 40,000 | Creditors | 20,000 |

| Debtors | 20,000 | Bills Payable | 15,000 |

| Prepaid Expenses | 10,000 | ||

| Total | 2,40,000 | Total | 60,000 |

Calculation:

(Liquid Assets or Quick Assets)/Current Liabilities

(Total Current Assets – Inventory – Prepaid Expenses)/Current Liabilities

(2,40,000 – 40,000 – 10,000)/60,000

1,90,000/60,000

3.16

In the above example the business has 3.16 units of liquid assets for every 1 unit of their short-term liabilities. Looking from the perspective of short-term solvency the company in this case is in a favorable condition.

Usually 1:1 is an acceptable number for acid test ratio since it shows that the business has 1 unit of quick asset for every 1 unit of short-term obligation. A lower ratio than 1:1 indicates financial difficulty for the business.

Short Quiz for Self-Evaluation

>Read What is Current Ratio?