Promissory Note

A promissory note is a financial instrument, in which one party promises in writing to pay a pre-determined sum of money to the other party subject to agreed terms. It can either be payable on demand or at a specific time. It may be paid to or to the order of the authorized party or to the bearer of the instrument.

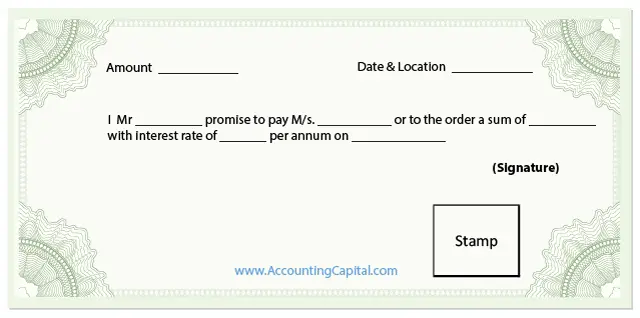

Terms of a promissory note include the amount of principal, the rate of interest (if any), name of both the parties (he who makes the promise is called the maker, and he to whom it is made is the payee), date of issuance, terms of repayment and the date of maturity.

Promissory notes are often unrecorded. There are two principal qualities essential to the validity of a promissory note. Firstly, it is payable at all events and is not dependent on any contingency. And secondly, it is to be for payment of money only.

Template for Promissory Note

Maker – is the individual or business which promises to pay i.e. the one who has availed the credit.

Payee – is the individual or business which is supposed to receive the payment i.e. the one who has allowed the credit.

Important Requisites

- The document must contain an unconditional undertaking to pay

- Amount to be paid must be fixed and certain

- It must be payable to or to the order of a certain person or to the bearer

- The document must be signed by the maker

A promissory note is signed by the person who borrows the money from the other party i.e. the lender. The note is kept by the lender as evidence of loan and the repayment agreement. Once the debt has been discharged, it must be cancelled by the payee and returned to the issuer.

A promissory note can be divided into two type viz., secured and unsecured promissory note.

Secured Promissory Note – It is based on the maker’s ability to repay, but it is secured with a collateral such as an automobile, land or a house.

Unsecured Promissory Note – It is not attached to anything; the loan is made based only on the ability of the maker to pay back the amount, generally its reputation & credit history plays a big role.

Short Quiz for Self-Evaluation

>Read Bill of Exchange