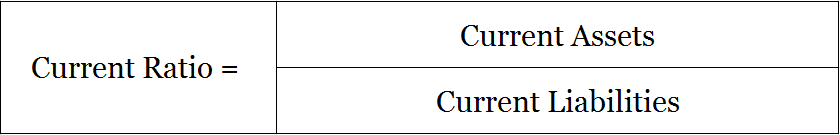

Current Ratio

The current ratio is a type of liquidity ratio which is established by dividing total current assets of a company with its total current liabilities. It shows the amount of current assets available with a company for every unit of current liability payable

This ratio helps to determine the short-term financial liquidity of a company which indicates how easily the company can meet its short-term financial obligations. It also aids to find out the relationship between current assets and current liabilities of a business.

Formula to Calculate Current Ratio

Current Assets: It includes Cash & its equivalents, B/R, Inventory, Marketable Securities, Debtors, Loans and Advances, Prepaid Expenses, etc.

Current Assets: It includes Cash & its equivalents, B/R, Inventory, Marketable Securities, Debtors, Loans and Advances, Prepaid Expenses, etc.

Current Liabilities: It includes Creditors, B/P, Outstanding Expenses, Provisions, Short-Term Loans etc.

Example of Current Ratio

From the balance sheet of Unreal corporation calculate their current ratio

| Liabilities | Amt | Assets | Amt |

| Share Capital | 2,00,000 | Plant & Machinery | 1,90,000 |

| Reserves & Surplus | 40,000 | Furniture | 10,000 |

| Short-Term Loans | 25,000 | Inventories | 60,000 |

| Trade Payable | 25,000 | Trade Receivable | 30,000 |

| Expense Payable | 10,000 | Short-Term Investment | 10,000 |

| Total | 3,00,000 | Total | 3,00,000 |

Calculation:

Current Assets/Current Liabilities

Inventories + Trade Receivable + Short-Term Investment / Short-Term Loans + Trade Payable + Expense Payable

= (60,000 + 30,000+ 10,000) / (25,000 + 25,000 + 10,000)

= 1,00,000 / 60,000

= 1.67

It shows that for every 1 unit of current liability payable the company has 1.67 units of current assets. An ideal no. for this ratio lies around 1.5 to 2.0 depending upon the kind of business.

Related Topic – What is Ratio Analysis?

High and Low Current Ratio

Higher the current ratio better the short-term strength of a company, but a deeper analysis of this ratio may also suggest problems such as poor working capital management, stock pile-up, inadequate credit management etc. anything above 2:1 could be considered as high.

On the other hand, a lower current ratio may indicate inadequate working capital & show that the company isn’t sound enough to meet its short-term financial obligations comfortably. A business with low levels may be seen as depending a lot on current liabilities. Anything below 1:1 may be considered as low.

Short Quiz for Self-Evaluation

>Related Long Quiz for Practice Quiz 20 – Current Assets

>Read What is Acid Test Ratio?