-This question was submitted by a user and answered by a volunteer of our choice.

Meaning of Non-Current Liabilities

Non-current liabilities are obligations of an entity that becomes due at a future date and such future date falls beyond 12 months. Whereas current liabilities are those obligations wherein an entity is liable to honour such obligations within 12 months.

Meaning of Debt

Debt is any sum of money borrowed by an entity or a person from another entity or a person. Debt is borrowed generally when such an entity has a cash crunch or liquidity crunch or if it has an urgency of making a payment or any other purpose. It can be a long term or a short term debt.

The amount borrowed can be said to be a debt only if such a contract specifies the intention to repay at a future date the amount so borrowed. The borrower might have to pay interest if it’s agreed earlier in the agreement.

Is Non-Current Liability a Debt?

The answer to the above question is that it depends. When we take a bank loan it’s a debt but in case of a deferred tax liability or a long term provision even though it’s a part of non-current liability but it can not be called a debt.

I will give you an example of when it shall be called a debt

You have a business of manufacturing bottles and there been a huge demand for such bottles in the market recently so you decide to increase the production but your plant has a limited capacity hence you decide to purchase a new plant with higher capacity but your entity is facing a shortage of funds hence you apply to the bank for a loan of such amount.

The bank sanctions such loans and transfers the amount so required. Now, The agreement states that the amount borrowed is repayable by you after 5 years.

The loan mentioned in the above case qualifies to be a non-current liability since the obligation to repay arises after 5 years i.e > 12 months. And it’s also an amount borrowed by a person or an entity from another person or an entity. Hence, it’s a perfect example of debt.

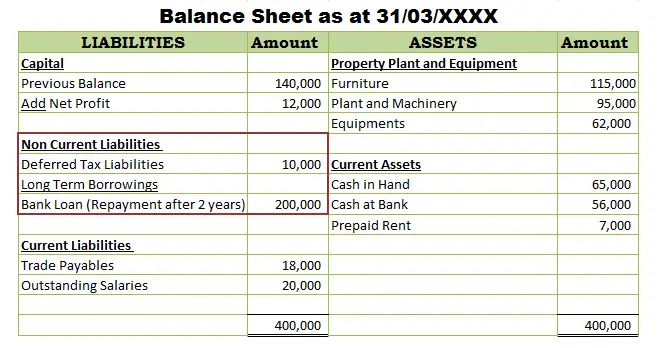

You will be able to understand from the below balance sheet that even though deferred tax liability is included under the head of non-current liabilities it does not signify to be a debt. And a bank loan having obligation to pay after a year is covered under long term debt.

Conclusion

All the non-current liabilities are not long term debts but all the long term debts are non-current liabilities.

>Related Long Quiz for Practice Quiz 22 – Current Liabilities