-This question was submitted by a user and answered by a volunteer of our choice.

Meaning of Provision for Discount on Debtors

Debtors are the entities who have purchased goods from the company on credit. They owe money to the business for such goods purchased.

In order to receive early payment from the debtors in the succeeding period, business entities provide incentives to the debtors who are ready to pay the outstanding amount before their credit period ends.

So, at the end of every period, entities will have to estimate the amount of discount that may be availed by the debtors in the succeeding period. This estimate will be based on past experience. Accordingly, a provision will have to be created in the current period as the amount of discount is an expected loss for the entity. This provision is referred to as “Provision for Discount on Debtors”.

Journal Entry for Provision for Discount on Debtors

The Journal entry for Provision for Discount on Debtors is given below:

| Profit & Loss A/c | Debit | Amt |

| To Provision for Discount on Debtors A/c | Credit | Amt |

(Being Provision for Discount on Debtors charged to Profit and Loss Account)

Example of the Journal entry

ABC Ltd. has Sundry Debtors of 50,000. Out of these, 5,000 turn out to be bad debts. The company decides to offer a discount of 5% to the remaining debtors amounting to 45,000 if they pay the owed amount before the credit period ends.

| Profit & Loss A/c | Debit | 4,500 |

| To Provision for Discount on Debtors A/c | Credit | 4,500 |

(Being Provision for Discount on Debtors charged to Profit and Loss Account)

Treatment of Provision for Discount on Debtors in Final Accounts

| Financial Statement | Treatment |

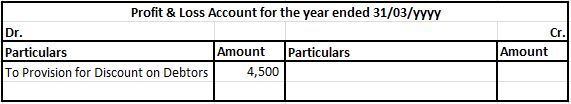

| Profit & Loss Account | Presented on the Debit side of the Profit & Loss account |

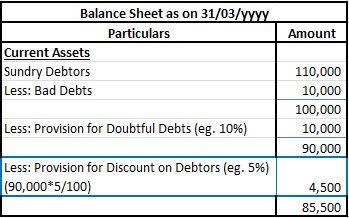

| Balance Sheet | Deducted from Sundry Debtors under the head Current Assets (after deducting Bad Debts & Provision for Doubtful Debts) |

Extract of Profit & Loss account and Balance Sheet have been attached for better understanding.

Conclusion

The following may be concluded from the above article:

- Debtors are the entities who owe money to the business on credit purchases.

- Discount is provided to such debtors as an incentive for early payment.

- The company maintains a provision for such discount as this discount may or may not be allowed.

- This estimate is generally based on experience.

- It is presented on the Debit side of the Profit & Loss account.

- It is Deducted from Sundry Debtors under the head Current Assets (after deducting Bad Debts & Provision for Doubtful Debts).