Overview of Income

Income is the money received by a business in exchange for goods or services sold. It could be both, received or yet to be received. In other words, it is a monetary inflow received either in cash or kind. It includes the revenue from various sources like dividends and interest received, selling goods or services, the commission received, etc.

There are two types of income or revenue shown in the income statement:

- Operating income: The income that is generated from the ordinary course of business such as Sales revenue.

- Non-operating income: The income that is generated from sources other than ordinary business activities such as Dividends received.

In accounting terms, economic benefits increase due to inflows. An increase in income should be credited to the books of accounts.

Related topic – Is Income Received in Advance an Asset or Liability?

As per Modern Rules of Accounting

| Account | Increase | Decrease |

|---|---|---|

| Income | Credit (Cr.) | Debit (Dr.) |

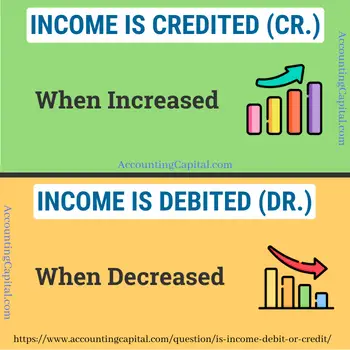

Income is Credited (Cr.) when increased & Debited (Dr.) when decreased.

Why is it like this?

This is a rule of accounting that is not to be broken under any circumstances.

How is it done?

For instance, you receive a commission for selling goods at the end of every month. The total amount of commission (income) would be added to the income statement for the current accounting year since this increases the total income of your business.

Below is the timeline of how it would be recorded in the financial books.

Step 1 – The following journal entry for commission received is recorded in the books of accounts when money is received. (Rule Applied – Cr. the increase in income or revenue)

| Cash A/c | Debit |

| To Commission Received A/c | Credit |

(Commission received in cash)

Step 2 – To transfer the income to “Profit & Loss A/c”.

| Commission Received A/c | Debit |

| To Profit & Loss A/c | Credit |

(Commission received is transferred to the income statement)

Related topic – Is Fees Earned a Debit or Credit?

As per the Golden Rules of Accounting

| Account | Rule for Debit | Rule for Credit |

|---|---|---|

| Nominal | All Expenses and Losses | All Incomes & Gains |

Income is Credited (Cr.)

As per the golden rules of accounting for (nominal accounts) incomes and gains are to be credited.

The account of expenses, losses, incomes, and gains are called Nominal accounts. Basically, nominal accounts are those accounts shown in profit and loss accounts or income statements. The balance of these accounts is always zero at the beginning of a financial year.

Example

Let’s say you rent out a premises and receive a monthly payment from the tenant. Consequently, this income (rent received) would be reflected on the income statement.

Below is the timeline of how it would be recorded in the financial books.

Step 1 – In the below example the journal entry for rent received is recorded and “Rent Received A/c” is credited. (Rule Applied – Cr. all incomes & gains)

| Bank A/c | Debit |

| To Rent Received A/c | Credit |

(Monthly rent received in the bank account)

Step 2 – To transfer the income to “Profit & Loss A/c”

| Rent Received A/c | Debit |

| To Profit & Loss A/c | Credit |

(Rent received is transferred to the income statement)

Any income received in advance is a liability for the receiver and it is shown on the liability side of the balance sheet.

Related topic – Capital is Debit or Credit?

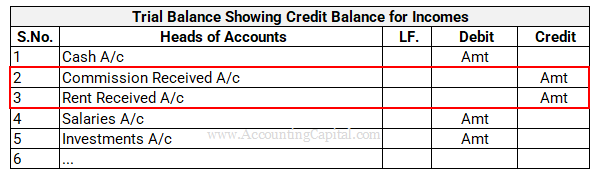

Incomes Inside Trial Balance

Incomes show a credit balance in the trial balance. A trial balance example showing a credit balance for commission and interest received is provided below.

>Read Is Expense Debited or Credited?