Overview of Purchase Return

When the buyer of goods returns the goods purchased back to the seller, the transaction is referred to as purchases return. The buyer may return the goods to the seller (the creditor) due to excessive purchases, defective goods, or any such reason. For recording this transaction, adjustments can be made to the Purchase A/c or a separate Purchase Return A/c can be created in the books of the buyer.

The purchase return account is credited for recording the transaction and the respective accounts payable are debited.

When the goods purchased by the business on credit are returned to the seller, it reduces the Accounts Payable and is a ‘gain’ or ‘income‘ for the organization, hence purchase return is a nominal account.

As per Modern Rules

| Account | Increase | Decrease |

|---|---|---|

| Income | Credit (Cr.) | Debit (Dr.) |

Purchase Return (Income) is Credited (Cr.) when increased & Debited (Dr.) when decreased.

Why is it like this?

This is a rule of accounting that is not to be broken under any circumstances.

How is it done?

For instance, you own a trading business and you purchased goods on credit from the supplier. Upon receiving the stock, you find a few defective items which you return to the supplier. In the financial books, the Purchase return account will be credited since it is an increase in income for the organization.

Given below is the timeline of how it would be recorded in the financial books.

Step 1 – The following journal entry is recorded in the books of accounts when the defective items are returned. (Rule Applied – Cr. the increase in income or revenue)

| Suppliers A/c | Debit |

| To Purchase Return A/c | Credit |

(Goods sent back to suppliers)

Step 2 – To transfer the income to “Trading A/c”.

| Purchase Return A/c | Debit |

| To Trading A/c | Credit |

(Goods returned are transferred to the trading account)

As per the Golden Rules of Accounting

| Account | Rule for Debit | Rule for Credit |

|---|---|---|

| Nominal | All Expenses and Losses | All Incomes & Gains |

Purchase Return (Income) is Credited (Cr.)

As per the golden rules of accounting for (nominal accounts) incomes and gains are to be credited.

The account of expenses, losses, incomes, and gains are called Nominal accounts. The balance of these accounts is always zero at the beginning of the financial year. Since the purchase return is an income for the business, it is to be credited.

Example

For instance, you manufacture bottles but a part of the raw material you purchased from the supplier is not of the required quality so you return the material to the supplier. In the financial books, the Purchase return account will be credited because it is an income for the organization since the amount payable to the supplier decreases.

Below is the timeline of how it would be recorded in the financial books.

Step 1 – For the above example, the journal entry for the raw material returned, “Purchase Returns A/c” is credited. ( Rule Applied – Cr. all incomes and gains)

| Suppliers A/c | Debit |

| To Purchase Return A/c | Credit |

(Raw material sent back to suppliers)

Step 2 – To transfer the income to the “Trading Account”

| Purchase Return A/c | Debit |

| To Trading A/c |

Credit |

(Materials returned are transferred to the trading account)

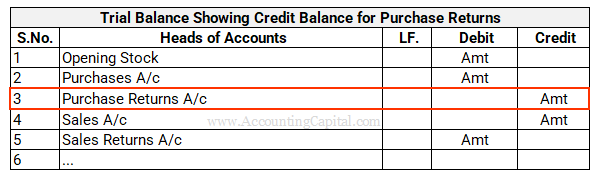

Purchase Return Inside Trial Balance

Purchase returns show a credit balance in the trial balance. A trial balance example showing a credit balance for purchase returns is provided below.

Read