-This question was submitted by a user and answered by a volunteer of our choice.

What is a Debit balance?

While preparing a ledger account (T-account), if the sum of the debit side is greater than the sum of the credit side, then we say that the account has a “debit balance“.

Debit side > Credit side

Assets have a debit balance

Let us understand this concept by correlating it with the golden and modern rules of accounting and with an example.

1. The golden rule of accounting for a real account (i.e. assets like plant & machinery, furniture & fixtures, etc) is

Debit what comes in, Credit what goes out

2. On the other hand, the Modern rule of accounting states-

Debit the increase in asset, Credit the decrease in asset

Keeping this in mind, we will move forward to an example.

Example for Asset A/c

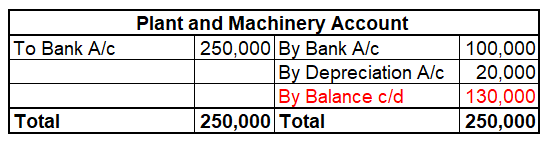

Samsung Inc. acquired 2 plants & machinery for 2,50,000. Out of the 2, it sold 1 for 1,00,000. Also, 20,000 depreciation was charged. So, the ledger account for plant & machinery will be presented as follows in the books of Samsung Inc.,

With the purchase of 2 plants & machinery, there will be an increase in the overall assets of Samsung Inc. So, we will have to debit the purchase/increase in the asset. And on the sale of any asset purchased before, you need to credit the asset account.

Therefore, in general, the debit side of an asset account will be > than the credit side, resulting in a debit balance.

In this example, the above ledger shows the debit balance (debit side > credit side) in plant & machinery A/c (By Balance c/d – 1,30,000).

What is a Credit balance?

While preparing a ledger account (T-account), if the sum of the credit side is greater than the sum of the debit balance, then we say that the account has a “credit balance“.

Credit side > Debit side

Liabilities have credit balance

Again, let’s just interpret this concept by correlating it with the rules along with an example.

1. The golden rule of accounting for personal accounts (eg. creditors) is;

Debit the receiver, Credit the giver

2. Modern rule of accounting states-

Credit the increase in liability, Debit the decrease in liability

Keeping these rules in mind, let us now understand why liabilities have a credit balance with an example.

Example for Liabilities A/c

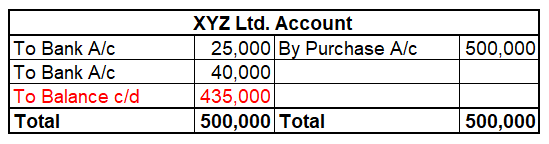

ABC Ltd purchased raw materials from its supplier XYZ Ltd for 5,00,000. During the month it could only make payments of 25,000 and 40,000 to the supplier. The remaining amount is still outstanding. So, the ledger account for XYZ Ltd (Creditors A/c) in the books of ABC Ltd will be presented as follows;

XYZ Ltd has been credited with 5,00,000 because he is the supplier of raw materials (credit the giver). Also, ABC Ltd is now liable to pay 5,00,000 (credit the increase in liability). Then as and when we pay XYZ Ltd, there will be a decrease in the liability, therefore debit. The liability account will show a credit balance until we discharge the dues completely.

So, in general, you will always see the credit side of the liability account to be > than the debit side.

In this example, the above ledger shows the credit balance (credit side > debit side) in XYZ Ltd A/c (To Balance c/d – 4,35,000).

Conclusion

The key points from the above discussion are given below:

- If the sum of the debit side is greater than the sum of the credit side in a ledger, then we say that the account has a “debit balance.

- If the sum of the credit side is greater than the sum of the debit balance in a ledger, then we say that the account has a “credit balance“.