Meaning & Definition

Set-off means discharging reciprocal monetary obligations by counterbalancing debt or claim. The set-off is carried out by debiting one account against a credit on another. The word “set-off” gives us the idea that it is related to writing off or reducing the value.

In simple accounting terms, when a debtor can decrease the amount of one’s debt by the amount owed by the creditor to the debtor, it is known as setting off. The creditor’s claim on the debtor is reduced by the amount of the debtor’s claim on the creditor. It is important to note that the claims are unrelated or separate transactions.

To set off a debit on one account against a credit on another, you deduct the debit from the credit. The balance you receive is the difference between the two amounts, either payable or receivable.

Set-off is crucial as all the accounts are reconciled to show a true and fair image of the financial position of the business.

Key Features of set-off : (with the exception of contractual set-off)

- both claims must be for the non-payment of money

- there must be mutuality of debts

Types of Set-off in Accounting

In commercial transactions, contractual set-off, banking set-off, and insolvency set-off are important. A set-off in terms of accounting is of the following types and applies accordingly:

1. Contractual set-off – Many times, a debtor agrees to exclude the right to set off based on a contract or business relations. In this case, although the creditor owes some amount to the debtor, it is considered nil, and the debtor is obliged to pay the entire amount of debt.

2. Banking set-off – The bank gets the right to set off a credit balance against another debit balance when a person has more than one account, i.e. combining two or more accounts held by the same entity.

3. Insolvency set-off – An insolvent debtor of the company may set-off its claims against its creditor.

4. Legal set-off (also known as independent set-off or statutory set-off) – Under legal proceedings, mutually exclusive unsettled debts between the two parties, arising from transactions unrelated to each other can be set off.

5. Equitable set-off (also known as transaction set-off) – It is an independent provision where the set-off is given at the discretion of the court. Here, the amount of set-off is according to the decision of the court.

6. Intercompany set-off – A company may have various subsidiaries. There are many transactions that happen between such entities. A set-off of the amounts owed by the entities to each other may help in determining an accurate financial position of the entities.

Example 1

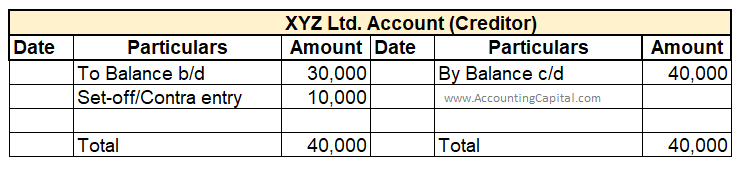

Mr A purchased goods from XYZ Ltd. amounting to 40,000. However, XYZ owes an amount of 10,000 to Mr A as per past unrelated transactions. The working of the amount owed by Mr A (the debtor) to XYZ (the creditor) as per their agreement is as follows:

Solution:

Mr A originally owes a sum of 40,000 to XYZ Ltd. Also, XYZ owes a sum of 10,000 to Mr A on the basis of prior transactions. So, Mr A is allowed to set off by paying only a sum of 30,000 (40,000 – 10,000) to XYZ as a settlement of the claim.

Here, XYZ Ltd. A/c is debited with 10,000, which represents the amount set off. The ledger account of XYZ in the books of Mr A is provided below.

The main benefit of using set-off in accounting is that it ensures payment security and hassle-free settlement of disputes at both ends.

Let us take another example to understand this concept better:

Example 2

ABC Ltd. and XYZ Ltd. are two companies. ABC has to pay XYZ 1,000 for goods purchased. On the other hand, XYZ has to pay 500 to ABC Ltd. for marketing services rendered by it. The companies mutually decide to set-off this amount.

On set-off, ABC has to now pay 500 (1,000 – 500) to XYZ in full and final settlement.

Conclusion

On a concluding note, we may say that:

- Set-off is a process of writing off a debit on one account against a credit on another.

- These two claims are separate transactions.

- Both the claims are for non-payment of money.

- There are various types of set-offs including Equity set-offs, Intercompany set-offs, Contractual set-offs, Banking set-offs, Insolvency set-offs and Legal set-offs.

- Set-off is crucial as all the accounts are reconciled which helps to show the true financial position of the entity.

- It helps in determining the actual amount receivable from or payable to an entity.