-This question was submitted by a user and answered by a volunteer of our choice.

I have answered this question on the assumption that “Trading Expenses are those expenses which are covered in the Trading Account”.

Meaning of Trading Expenses

Trading Expenses are direct expenses incurred for the purchase and production of goods. They are related to the core business operations of the business entity and directly related to the purchase and production of the finished goods.

So, all the expenses incurred from the time of purchasing raw materials/goods till the time the finished goods are brought to a saleable condition are referred to as trading expenses.

For example: carriage inward, manufacturing expenses, wages, etc.

Features of Trading Expenses

Presentation in Financial Statements

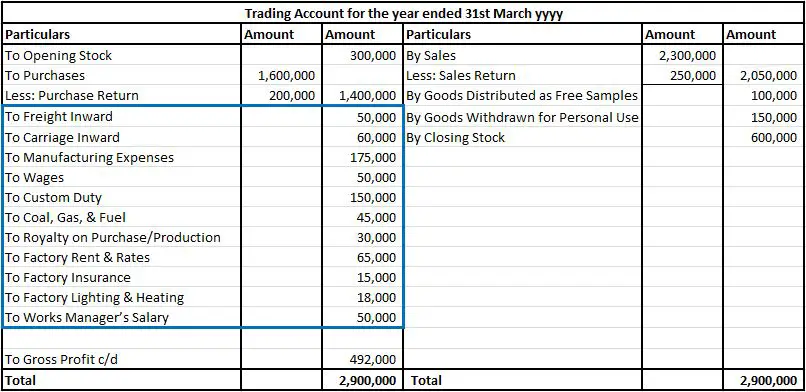

| Particulars | Financial Statement | Treatment/Presentation |

| Trading Expenses (Direct Expenses) | Trading Account | Presented on the Debit side of Trading Account |

A snippet of the Trading account has been attached for better understanding.

Conclusion

Hence, trading expenses are debited to the trading account to accurately reflect the costs incurred in the process of buying and selling goods or financial instruments.

This helps in determining the gross profit derived from trading activities before other expenses are considered.