-This question was submitted by a user and answered by a volunteer of our choice.

Meaning of Petty Cash Book

A petty cash book is like a ledger account that records small day-to-day expenses. Once the set amount for the petty cash book is used up for minor expenses it is replenished with the same amount.

Petty cash book follows an imprest system of accounting. This means that a fixed amount of money is set aside to cover small and routine expenses.

Examples of petty cash books include office supplies, refreshments, postage, transportation, small repairs, etc.

Why is the petty cash book important?

- A petty cash book is important since it helps in tracking the small expenses that might be unnoticed or not recorded. This helps in keeping the company organized in its expenses. This shows the company’s responsibility and accountability.

- It helps the company run within its budget rather than spending too much as the minor expenses are being monitored by recording them.

- It is a convenient way to handle small expenses rather than the formal process of issuing cheques etc.

Type of Account

“Petty cash” is an asset and is shown under the category of current assets in the balance sheet. It is a current asset since the petty cash expenses occur within the operating year.

Petty cash book has a debit balance (or) positive balance since the amount is transferred from cash to petty cash and the amount being spent on petty cash expenses is reduced from the debit balance and later replenished.

Received 250 from the head cashier for all petty cash expenses. Journalise the following transaction.

As per the Modern Approach,

According to modern rules whenever there is an increase in the value of the asset then the particular asset account is debited and when there is a decrease in the value of the asset it is credited.

| Accounts Involved | L.F. | Amount | Nature of Account | Accounting Rule |

| Petty cash a/c | 250 | Asset | Debit– The Increase in Asset | |

| Cash a/c | 250 | Asset | Credit– The Decrease in Asset |

The amount of petty cash will increase when debited as this leads to an increase in petty cash as an asset. This also leads to a decrease in cash account. The cash account will be credited since there is a decrease in assets.

As per the traditional approach,

| Particulars | Debit | Credit | Rules |

| Petty cash a/c | 250 | Real a/c – Debit what comes in | |

| To Cash a/c | 250 | Real a/c- Credit what goes out |

As per the traditional rules, the petty cash expenses are coming in hence it is debited. As the cash is being spent on these expenses, the cash is going out, it is credited.

Example

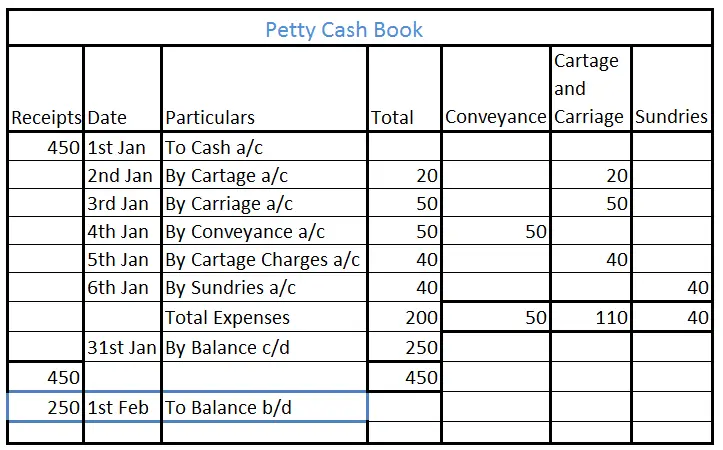

Prepare a Petty Cash Book on the imprest system from the following data as provided below-

| Date | Particulars | Amount |

| Jan 1 | Received cash from head cashier | 450 |

| 2 | Paid cartage | 20 |

| 3 | Paid for carriage | 50 |

| 4 | Paid for bus fare | 50 |

| 5 | Cartage charges | 40 |

| 6 | Refreshments to customers | 40 |

Petty Cash Book

The normal opening balance of cash will be placed on the Left-Hand Side under the cash receipts column. Total payments are shown on the Right Hand Side of the petty cash book.

This example shows the total amount in cash is 450 and is credited in the petty cash book amount. Later, as the expenses occur it is recorded and finally subtracted from the total cash.

Conclusion

- The petty cash book is important because it helps companies maintain financial health, manage their budget, and ensure transparency and accountability.

- It is a current asset, as it can be converted into cash, sold, or consumed within the normal operating cycle of the business, usually within one year.

- The normal balance of petty cash will show a positive balance (or) debit balance.