-This question was submitted by a user and answered by a volunteer of our choice.

In accounting, beginning and ending balances are used interchangeably with opening and closing. For the sake of easy understanding, I am assuming the beginning and ending balance of an account to be the opening and closing balance of a ledger account.

Opening Balance

In the ledger, balance b/d means opening (or) the beginning balance of an account. Balance b/d refers to that balance that is brought down (or) forward to the current accounting period from the previous accounting period. In simple terms, the ending (or) closing balance at the end of the month becomes the opening balance for the next month.

Opening balance can be debit- To (or) credit- By. According to the modern accounting approach, assets, liabilities and owner’s equity (capital) have opening balances.

For Example- On 31st March YYYY, the closing balance of the machinery was 500,000. What will be the opening balance of machinery on 1st April YYYY?

Dr Machinery Account Cr

|

Closing Balance

In the ledger, Balance c/d means closing (or) ending balance of an account. Balance c/d refers to the amount that is carried down (or) forward from the current accounting period to the next accounting period. Balance c/d is the difference between the debit side and credit side of the ledger used for balancing the accounts.

If the debit side exceeds the credit side, then the balancing figure (say balance c/d) appears on the credit side of the ledger and vice-versa. Closing balance can be debit- To (or) credit- By.

Example- Mr X purchased furniture for 200,000. Depreciation is to be charged at 10% as per the Straight Line method. What will be the closing balance as of the year-end?

Dr Furniture Account Cr

|

According to the modern rules, Assets shows opening (or) beginning balance on the debit side whereas, Liabilities and Owner’s equity (capital) shows the opening balance on the credit side. The closing balance (or) ending balance is placed on either side of the opening balance.

For example- If the opening balance of machinery is shown on the debit side of the ledger account then the closing balance of the machinery will be shown on the credit side to balance the ledger account.

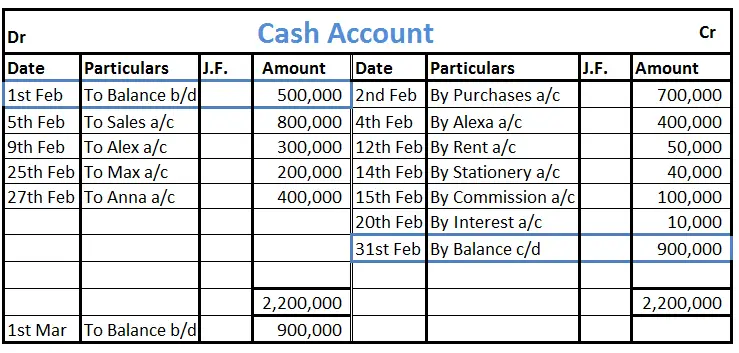

To make the above concept easy and understandable, a snippet of the cash account will help you in understanding the opening and closing balance of an account.