-This question was submitted by a user and answered by a volunteer of our choice.

What is Amortization?

Amortization can be referred to as the depreciation of intangible assets such as goodwill, patent, trademarks, copyrights, computer software, etc. It is the reduction in the value of intangible assets over a period of time.

Intangible assets having definite useful life lose their value over time due to technological changes, contract expirations, etc. So, finite-life intangible assets are amortized on a straight-line basis over the period of their estimated useful lives.

Journal Entry

The journal entry for charging amortization expenses in the books of accounts is as follows-

| Amortization Expense A/c | Debit | amt |

| To Intangible Assets/Accumulated Amortization Expenses A/c | Credit | amt |

Rules as per the Modern Approach

| Account | Nature of Account | Rule |

| Amortization Expense A/c | Expense | Debit the increase in expense |

| To Intangible Assets/Accumulated Amortization Expenses A/c | Asset | Credit the decrease in asset |

Treatment in the Financial Statements

Amortization expenses are shown in both the Balance Sheet and Profit and Loss account.

| Financial Statement | Treatment |

| Profit and Loss account | Presented as “Depreciation and Amortization Expenses” under the head Expenses |

| Balance Sheet | Reduced from the respective Intangible Assets under the head “Non-Current assets” |

Let us also understand the same with the help of an example.

Example

Suppose Infosys Inc. acquired a new computer software for 1,000,000 in the month of January 20×1. The estimated useful life of the software is 5 years.

In this case, computer software worth 1,000,000 will be recorded as an intangible asset at the time of acquiring the software.

However, it will be amortized at the end of each year for 5 years on a straight-line basis ie. 200,000 will be recorded as an expense and will be written-off from the amount of software each year for 5 consecutive years.

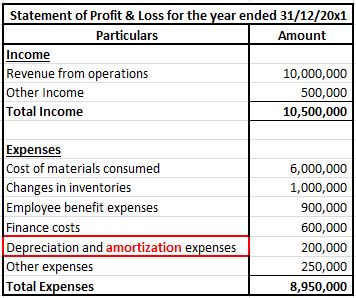

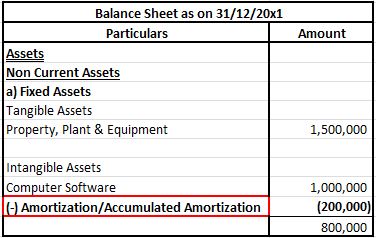

An extract of Profit & Loss A/c and Balance Sheet has been attached for a better understanding of the presentation of amortization expenses.

The above profit & loss extract shows 200,000 has been recorded as amortization expenses for the period Jan-Dec 20×1.

The above balance sheet extract shows 200,000 amortization expenses written-off from the amount of computer software for the period Jan-Dec 20×1. The balance of 800,000 will be proportionately written off in the next 4 years.

>Related Long Quiz for Practice Quiz 15 – Amortization