- Direct Expenses (Meaning & Definition)

- Indirect Expenses (Meaning & Definition)

- Direct Expenses Vs Indirect Expenses (Table Format)

- Quiz

- Conclusion

Expenses are amounts paid for goods or services purchased. They can either be directly or indirectly related to the core business operations. The type of expense and timing at which it is incurred by the business frames the key points of difference between direct and indirect expenses.

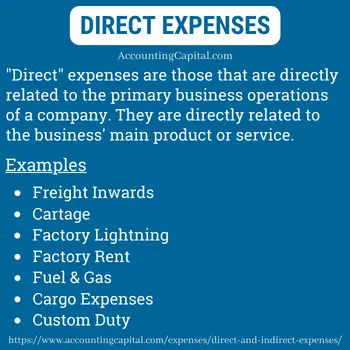

Meaning & Definition of Direct Expenses

“Direct”, as the word suggests, are those expenses directly related and assigned to the primary business operations of a business. In general, they relate to the purchase and production of goods and services.

They are expenses associated with purchasing goods and delivering them to a business location.

Such expenses are a part of the prime cost or the cost of goods/services sold by a company. They are also called direct costs and are directly related to the production of the main revenue-generating product or service.

They may differ for different types of companies, such as manufacturing companies, construction companies, technology companies, etc.

Real-life Examples

- Imagine that you own a restaurant. The money spent on ingredients, rent of the restaurant, the chef’s salary, utility bills, etc., are all direct expenses.

- Imagine that you are a retailer. The money spent on buying products wholesale, travelling expenses to the wholesaler, fuel and gas, etc., will be the direct costs.

- Suppose you own a salon. In this case, no product is sold since it is a business in the service industry. Money spent on shampoos, combs, dyes, conditioners, etc., would be directly attributable to costs.

Examples of Direct Expenses

- Wages

- Factory rent

- Cost of raw material

- Premises renting

- Carriage inwards

- Fuel, etc.

Related Topic – Capex and Opex (Capital Expenditure & Operating Expenditure)

Direct Expenses List (with PDF)

The main logic to categorising any expense as direct is to ask yourself, “is the cost directly linked and attributable to the primary income-generating product of the company?”. If the answer is “Yes”, then it is most likely a direct expense.

Our team researched and compiled a list of the most commonly seen direct expenses.

General

- Wages

- Freight Inwards

- Manufacturing Expenses

- Factory Lighting

- Factory Rent

- Factory Insurance

- Gas, Water and Fuel

- Cargo Expenses

- Import Duty

- Shipping Expenses

- Dock Dues

- Octroi

- Motive Power

- Clearing Charges

- Custom Charges

- Coal, Oil, and Grease

- Overhaul of Machinery

- Repairs of Machinery

- Upkeep and Maintenance

- Loading and Unloading

Service Industry

In the service industry, some commonly seen direct expenses are:

- Salaries to professionals who provide the services.

- Amounts paid to other freelancers and part-timers.

- Other costs of rendering services, e.g. Fuel & Gas, etc.

Construction Industry

In the construction industry, some commonly seen direct expenses are:

- Construction Material costs

- Labour costs

- Equipment

- Subcontracting fees

PDF Download – List of Direct Expenses

Related Topic – Is Depreciation an Operating Expense?

Are Direct Expenses Operating Expenses?

Direct expenses are not the same as operating expenses

Why?

Operating expenses are also known as operating costs, operating expenditures, etc. It is the cost that a business must incur on a day-to-day basis to function properly. Examples: Utility bills, marketing, office supplies, office rent, etc.

On the other hand, direct expenses are those that are incurred in order to manufacture or produce products/services that are then sold in the market to generate income. Examples: Factory rent, factory power, wages, etc.

Note the difference between the words “factory” and “office”.

- In a factory, costs incurred are directly related to the production of the product or service (direct expense).

- An office refers to a workplace that deals mainly with selling and administrative activities (operating expenses or indirect expenses)

Related Topic – Difference Between Loss and Expense

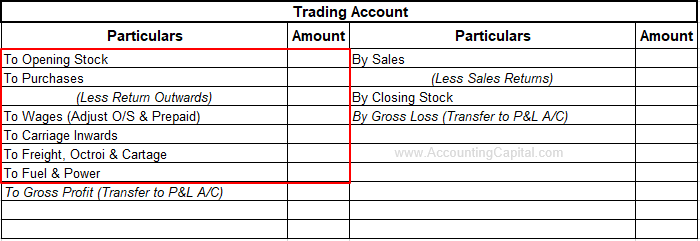

Direct Expenses in Trading Account

This heading will answer a frequently asked question related to the topic “where are direct expenses shown or entered?”

Direct expenses are shown on the debit side of a trading account because costs related to the production, procurement, buying and selling of goods/services should appear in this account.

This is where the initial gross profit or gross loss is determined.

Related Topic – What are Sundry Expenses?

Direct Expenses in the Service Industry

Intellectual skills, knowledge, expertise, and experience are among the few intangible items a business sells when running operating in the service industry. It does not involve a physical product. Examples: Accounting services, IT consulting, Hospitality, Payroll, Cleaning Business, etc.

Some service industry players need inventory, while others do not. Direct material costs consist of the parts and supplies you use, e.g. a cleaning company would use cleaning supplies, mops, brooms, etc. For such companies, these are direct expenses along with any other necessary costs associated with the action of providing services.

On the other hand, personal service companies such as an accounting firm (e.g. KPMG) may not require to spend anything as direct material costs. For such service,

- A professional’s salary.

- Money paid to freelancers & employees who work part-time.

- Expenses directly associated with rendering services.

Cost of Services

Direct and Indirect costs can be declared on the income statement as expenditures since a personal service company does not hold inventory.

You can also use an independent “Cost of Sales A/c” to list the expenses on the profit and loss account. As an independent line item, each expense is reported separately.

Related Topic – Expense is Debit or Credit?

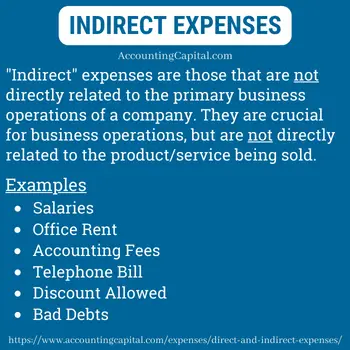

Meaning of Indirect Expenses

Unlike direct, indirect expenses are not directly related and assigned to the core business operations of a firm. They are also known as Opex or operating expenses.

Indirect expenses are necessary to keep the business up and running, but they can’t be directly related to the cost of the core revenue-generating products or services.

Just like direct expenses, indirect expenses can also be different for diverse organisations. These are usually shared costs among different departments/segments within the firm.

Examples of Indirect Expenses

- Salaries

- Telephone bills

- Printing & Stationery

- Legal & Accounting charges

- Carriage outwards

Related Topic – Profit and Loss Suspense Account

Indirect Expenses List (with PDF)

The main logic to categorising any expense as indirect is to ask yourself, “is the cost directly linked and attributable to the primary income-generating product of the company?”. If the answer is “No”, then it is most likely an indirect expense.

Our team researched and compiled a list of the most commonly seen indirect expenses.

- Office Rent, Rates & Taxes

- Salaries

- Legal Charges

- Audit Fees

- Advertisement Expenses

- Commission Paid

- Discount Allowed

- Depreciation

- Bank Charges

- Printing & Stationery

- Travelling Expenses

- Salesmen Salaries

- Warehouse Insurance

- Delivery Van Expenses

- Packing Charges

- Carriage Outwards

- Premises Rent (office-related)

- Brokerage Charges

- Postage & Cartage

- Selling Expenses

- Telephone Expenses

- Interest Payments

- Sundry Expenses

- Bad Debts

- Repairs & Renewals

PDF Download – List of Indirect Expenses

Are Indirect Expenses and Overheads the same?

As per Wikipedia, overhead or overhead expense “refers to an ongoing expense of operating a business. Overheads are the expenditure which cannot be conveniently traced to or identified with any particular revenue unit”.

Overhead expenses are crucial for business operations, but it is nearly impossible to directly associate them with products or services sold by the firm. They do not play a direct role in generating profits.

Yes, overheads and indirect expenses are mostly similar. However, some overhead costs (exceptions) can be directly related to a product, so a part of such costs may be direct.

For a deeper understanding of this topic, we recommend reading these two concepts on Wikipedia. Overhead Expense & Indirect Costs.

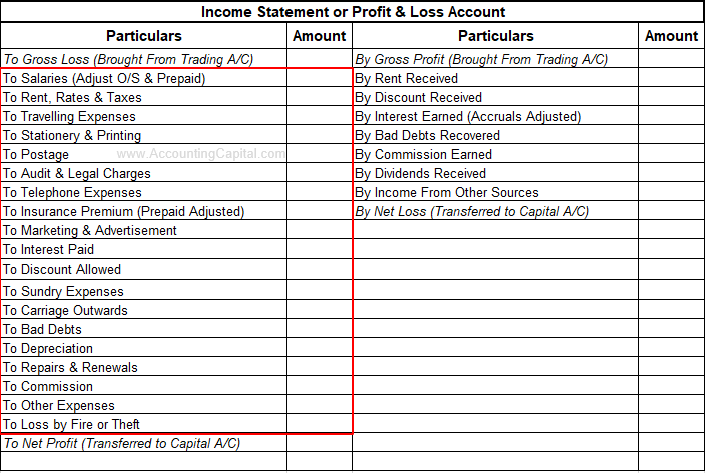

Indirect Expenses in Final Accounts

This heading will answer a frequently asked question related to the topic “where are indirect expenses shown or entered?”

Indirect expenses are shown on the debit side of an income statement this is because costs which are not directly related to the production, procurement, buying and selling of goods/services should appear in this account.

It is here that the net profit and net loss are determined.

Related Topic – Paid Telephone Bill Journal Entry

Is Salary a Direct or Indirect Expense?

Employers pay salaries to their employees as compensation for the work they perform. If the salary expense can not be directly related to the production of products/services being offered by the company, then it is an indirect expense.

In most cases, salary is an indirect expense shown in the profit & loss account.

Another question asked often is, “Why are wages direct but salaries indirect expense?”

Wages, on the other hand, are payments made for a specific period of time. In the modern scenario, this can be related to freelancers and part-time workers.

Traditionally wages have always been categorized as direct expenses as it is assumed that they are related to the compensation made to the factory workers who help produce the primary selling item for the company.

In contrast, it is presumed that the money paid to other employees (not factory workers) is called salaries. This logic leads to wages becoming direct expenses, as opposed to salary expenses becoming indirect expenses.

Although the situation may be different in today’s world, direct and indirect expenses should be handled according to their respective rules regardless of the expense.

Related Topic – Journal Entry for Salary Due

Direct Vs Indirect Expenses in a Table Format

| Direct Expenses | Indirect Expenses |

| 1. Expenses or direct costs incurred while manufacturing the main “product” or “service” of the company are termed direct expenses. | 1. Expenses or indirect costs which are not directly related to the core “product” or “service” of the company are termed indirect expenses. |

| 2. They become a part of the total cost of goods/services sold. | 2. Indirect expenses are not included in the total cost of goods/services sold. |

| 3. Shown on the debit side of a trading account. | 3. Shown on the debit side of an income statement. |

| 4. Direct expenses can be allocated to a specific product, department or segment. | 4. Indirect expenses are usually shared among different products, departments and segments. |

| 5. Examples – Direct labour (wages), cost of raw material, power, rent of factory, etc. | 5. Examples – Printing cost, utility bills, legal & consultancy, postage, bad debts, etc. |

Related Topic – Meaning of Write-off or Expense-off

Short Quiz for Self-Evaluation

Conclusion

To understand and study direct expenses, it is important to study the company’s Trading Account. All the trading activities are recorded here. Therefore, it is the primary source for obtaining data related to the company’s essential buying and selling.

To understand and study indirect expenses, it is important to study the company’s Income Statement. All the operating activities of a company are recorded here. Therefore, it is the primary source of information for anything unrelated to the core revenue generation activities.

There is a clear difference between direct and indirect expenses. Other similar terms are:

- Fixed cost

- Variable cost

- Operating cost

- Non-operating costs

- COGS

- Extraordinary Expense

- Capital Expenditure, etc.

However, they may all be different when you deep-dive and understand them thoroughly.

>Related Long Quiz for Practice Quiz 23 – Direct and Indirect Expenses

>Read Receipt Vs Income Vs Payment Vs Expenditure