-This question was submitted by a user and answered by a volunteer of our choice.

Provision for Depreciation in the Trial Balance

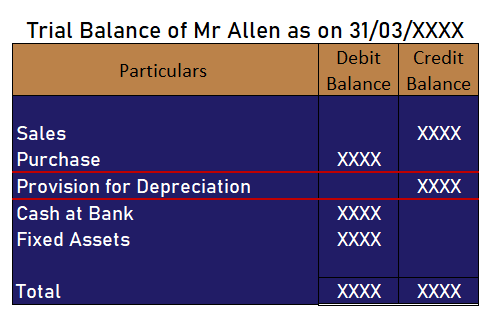

A trial balance shows provision for depreciation as a “credit item”. The value of most of the assets reduces over a period of time. It’s a common practice to record the assets at their historical cost but over a period of time, does the value of the asset remain the same as at the time of its purchase?

Obviously “Not”. So, if the asset has a debit balance then the provision for depreciation can not have a debit balance i.e it is bound to have a credit balance.

The below-given image would also be of great help to understand the above para.

What is Provision for Depreciation?

The fixed assets are depreciated over a period of time. Depreciation while is deducted from an income statement every year it is not deducted from an asset rather it is recorded on the liability side as accumulated depreciation or provision for depreciation. It’s a contra asset.

To find the net book value at the time of disposal of the asset or year-end or revaluation etc. one needs to subtract the provision for depreciation account balance from the historical cost of the asset. Such provision being a contra asset has a credit balance.

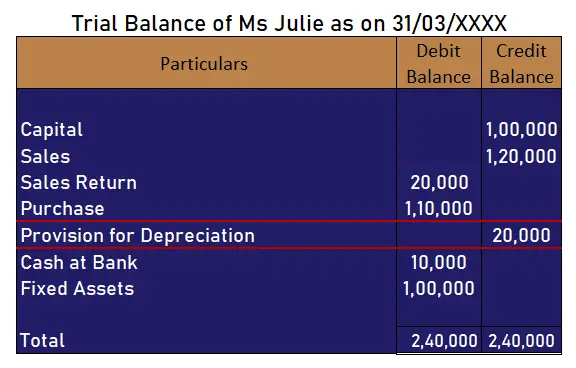

The illustrative example given below in the form of a problem might be of some help.

Prepare a trial balance of Ms Julie from the data given below;

| Particulars | Amount |

| Capital | 1,00,000 |

| Sales | 120,000 |

| Purchases | 110,000 |

| Sales Return | 20,000 |

| Fixed Assets | 100,000 |

| Cash at bank | 10,000 |

| Provision for Depreciation | 20,000 |

Solution:

I hope that your question now has been answered.