-This question was submitted by a user and answered by a volunteer of our choice.

Return Inwards

Return inwards is also called sales returns or sales allowances, it refers to the customers returning their products to the company. These returns happen when the customer is dissatisfied with the product or receives a defective product.

In layman’s language, return inwards refers to the goods returned by the buyer (customer) to the seller (i.e., selling entity) due to various issues.

The amount of return inwards (or) sales returns is deducted from the total sales of the firm. This is treated as a contra-revenue transaction meaning deducted from the revenue itself.

Why are sales returns books important to maintain?

- It helps in keeping track of the financial records and helps in ascertaining the financial accuracy.

- Maintaining sales returns books helps in understanding customers’ returns their dissatisfaction, and potential issues with the product. This will help the company in taking corrective measures.

- Tracking return inwards helps in adjusting the inventory and helps in providing the accurate amount of stocks.

Journal Entry

As per modern rules,

When there is a sales return the journal entry will be

| Particulars | Debit | Credit | Rule |

| Sales return A/c | Amt | Dr- The Decrease in Income | |

| To trade receivables | Amt | Cr- The Decrease in Asset |

As per modern rules, an increase in revenue is credited, and a decrease in revenue is debited. As the products are returned to the company it leads to a decrease hence, the sales return account is debited since there is a decrease in income or revenue.

This will lead to a decrease in the trade receivables account. Trade receivables is an asset account where the company needs to receive money in the future. As the goods are being returned, trade receivables decrease, leading to decreased assets.

As per traditional rules,

When there is a sales return the journal entry will be

| Particulars | Debit | Credit | Rule |

| Sales return A/c | Amt | Nominal A/c – Dr the expenses, losses | |

| To trade receivables | Amt | Personal A/c – Cr the giver |

As per traditional rules, the sales returns are debited since it is a loss for the company. Most importantly it is a contra revenue meaning a decrease from the total revenue.

The trade receivables are credited since he is returning it back to the company which makes him the giver as it is a personal account.

Example

On 1st May, Max Ltd. (a dealer in refrigerators) sold 20 refrigerators for 5,00,000 on credit to Alexa Ltd. On 25th May they returned all the refrigerators to Max Ltd. due to the serious defects in the model of the refrigerators. Pass journal entries for the above transaction in the books of Max Ltd.

In the books of Max Ltd (Modern Approach)

a) As per traditional rules

| Date | Particulars | Debit | Credit | Nature of Account | Accounting Rule |

| 25th May | Sales return a/c | 500,000 | Nominal | Debit- The expenses and losses | |

| To Alexa Ltd A/c | 500,000 | Personal | Credit- The giver |

(Being goods returned by Alexa Ltd due to serious defects)

As the goods are being returned to the firm, it is debited since it is a loss for the company. The Alexa Ltd is credited since it is a personal account and the giver is returning to the company.

b) Entry for the return of goods sold to Alexa Ltd.

| Date | Particulars | L.F. | Amount | Nature of Account | Accounting Rule |

| 25th May | Sales return a/c Dr | 500,000 | Income | Debit- The Decrease in Income | |

| To Alexa Ltd a/c | 500,000 | Asset | Credit- The Decrease in Asset |

(Being goods returned by Alexa Ltd due to serious defects)

Sales returns are debited since there is a decrease in revenue and Alexa Ltd is credited since there is an increase in the asset.

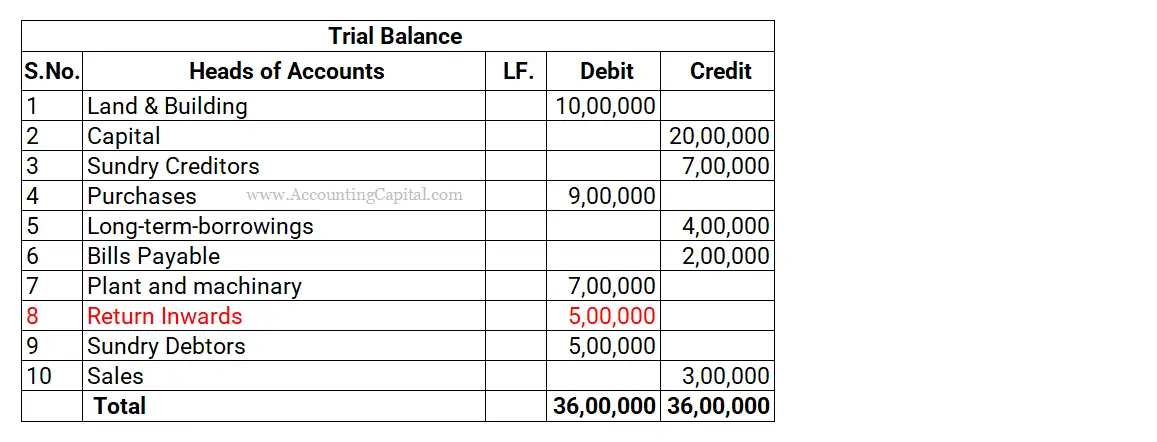

Placement in Trial Balance

Return inwards or sales returns hold the debit balance and are placed on the debit side of the trial balance as it will be reduced from the total sales.