-This question was submitted by a user and answered by a volunteer of our choice.

Sales Return and Allowances

When the goods or commodities are sold by the dealer or a manufacturer to the customer and the customer returns these goods or part thereof then such return made by the customer is called a sales return for the seller or the dealer.

It’s a contra revenue account. It is reduced from the total sales amount. Generally, it is recorded in the “Sales Return and Allowance Account”.

Accounting Treatment of Sales Return in Books of Accounts;

When initially the goods are sold on credit and later on a part of them are returned the journal entry shall be,

| Sales Returns and Allowance A/c | Debit | Debit the decrease in income |

| To Sundry Debtor A/c | Credit | Credit the decrease in an asset |

When goods are sold initially for cash and later on a part of them are returned;

| Sales Returns and Allowance A/c | Debit | Debit the decrease in income |

| To Cash A/c | Credit | Credit the decrease in an asset |

Example

You have a stationery store and a customer placed an order to buy 4 packs of blue gel pens but mistakenly you delivered 3 packs of blue and 1 pack of black pens. Each pack is sold for an amount of 100.

Initially, you must have recorded sales in your book as;

| Sundry debtor A/c | Debit | 400 | Debit the increase in an asset. |

| To Sales A/c | Credit | 400 | Credit the increase in income. |

Now, the customer placed an order for 4 packs of blue gel pens and you sent 3 packs of blue gel and 1 pack of black gel pens hence, the customer returns a pack of black gel pens.

Now, you will record this return in your books as;

| Sales Returns and Allowance A/c | Debit | 100 | Debit the decrease in income. |

| To Sundry Debtor A/c | Credit | 100 | Credit the decrease in an asset. |

Sales Allowance

When the goods are sold by the seller or the dealer and a few of them are defective or damaged or not as per the specification for that matter then to maintain the relationship with the customer the seller sometimes grants allowances.

Such allowances granted are called sales allowances. It is a contra revenue account. And hence, it’s reduced from the total sales.

Accounting Treatment

When initially the goods are sold on credit and later on it was discovered that a part of them are defective the seller extends some allowance. The journal entry for this transaction shall be;

| Sales Returns and Allowance A/c | Debit | Debit the decrease in income |

| To Sundry Debtor A/c | Credit | Credit the decrease in an asset. |

When initially the goods are sold on a cash basis and later on it was discovered that a part of them are defective the seller extends some allowance. The journal entry for this transaction shall be;

| Sales Returns and Allowance A/c | Debit | Debit the decrease in an income |

| To Cash A/c | Credit | Credit the decrease in an asset. |

For Example,

Mr Alex has a business dealing in shirts. He sold 10 shirts to Mr Allen. The price of each shirt was 100 and so Mr Allen immediately paid 1000 cash.

At the time of initial recognition of sales, Mr Alex recorded it in his books as;

| Cash A/c | Debit | 1000 | Debit the increase in an asset. |

| To Sales A/c | Credit | 1000 | Credit the increase in income. |

Later on, Mr Allen found that one of the shirts was defective and hence, he gave an intimation of the same to Mr Alex. Mr Alex agreed to give him an allowance and thus gave him a 50% discount on that shirt. The journal entry for the same shall be –

| Sales Returns and Allowance A/c | Debit | 50 | Debit the decrease in an income |

| To Cash A/c | Credit | 50 | Credit the decrease in an asset. |

The sales are recorded as a net of all the returns and allowances made by the seller during the accounting period.

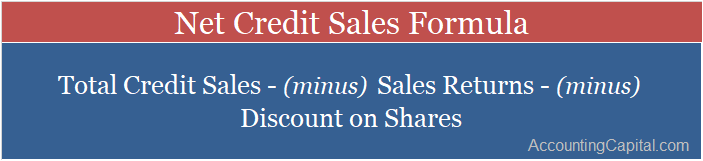

The following image illustrates the formula for net credit sales;