Meaning and Definition

As we know, final accounts are prepared at the end of an accounting period, by that time ledger balances also change due to day-to-day business transactions. Therefore, ledger balances are also required to be updated with relevant adjustments.

Examples of such transactions are depreciation, closing stock, accruals, deposits, etc. Adjustment entries relating to these transactions are passed and posted to respective ledger accounts to bring the ledger accounts to their appropriate balances.

Once all the necessary adjustments are absorbed a new second trial balance is prepared to ensure that it is still balanced. This new trial balance is called an adjusted trial balance. All ledger balances and their respective debit and credit balances are listed within this and are further used to prepare the financial statements of a company.

Example

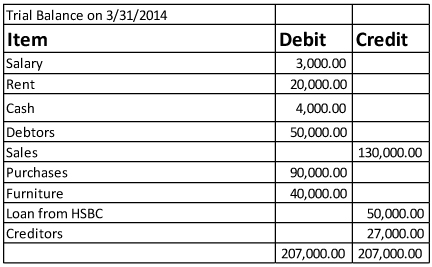

Suppose Unreal Pvt. Ltd. runs a small business and its trial balance as on March 31, 2014, is as follows:

The following additional information is also to be incorporated into the above trial balance thereafter an adjusted trial balance is to be furnished.

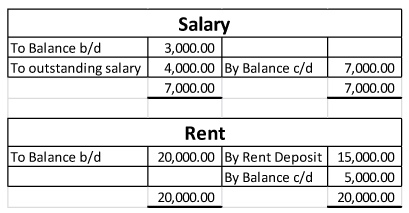

- The salary due to employees as on 31 March 2014 is 4,000

- Rent includes a refundable deposit of 15,000

The following entries will be recorded in their respective ledger accounts

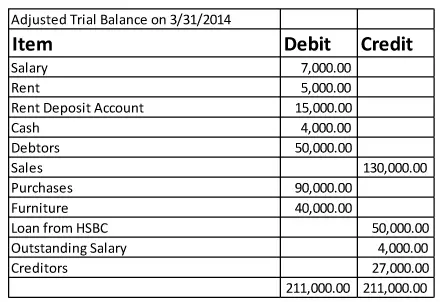

Adjusted Trial Balance

Hence the trial balance thus made is the one which includes all considerable adjustments and can be termed an adjusted trial balance.

Purpose of Adjusted TB

An adjusted trial balance is usually the last step in the accounting cycle because the financial statements are prepared after this. This adjusted trial balance is a report in which all the debit and credit balances are provided.

Preparing an adjusted trial balance can serve a variety of purposes, some of which are stated below,

- The very first and main purpose is to show that the debit balances match the credit balances

- Trial balance is used to prepare financial statements every year such as balance sheets, income statements, and cash flow statements.

- An adjusted trial balance ensures that the financial statements for the year are accurate.

- This trial balance is also useful in determining whether the adjusting entries at year-end are made correctly or not

- This adjusted trial balance helps in supervising the company’s performance because it acts as a final version of the accounts and gives a better and clearer picture altogether.

Adjusted Trial Balance to Income Statement

Once the adjusted trial balance is prepared after adjusting all the required entries in it, the next step is to prepare the financial statements from this adjusted trial balance such as the balance sheet, income statement, and cash flow statement.

The very first financial statement prepared is the income statement. The company will start by looking into the adjusted trial balance and taking out all the revenue and expense accounts and putting the information in the income statement.

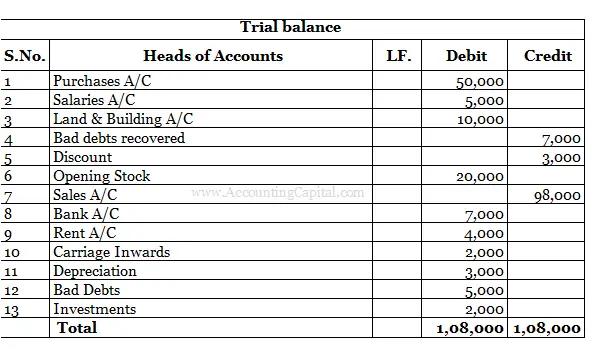

Let us see the following example,

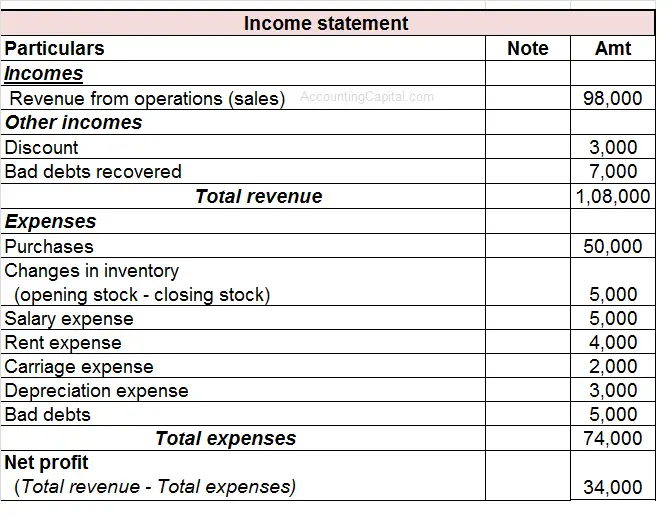

After looking at the above trial balance we can easily recognize the items that will go into the income statement of an enterprise. After recognizing the revenues and expenses we will post them in the income statement.

The income statement will be made as follows,

This way the income statement will be prepared showing all the revenue and expenses of that particular accounting period taking from the adjusted trial balance and at last, showing the net profit which is the difference between all the revenues and expenses.

Unadjusted Trial Balance

An unadjusted trial balance is a raw form of trial balance where all the general balances of the ledger accounts are directly posted and no adjusting entries are made. When such type of trial balance is made, all the balances of ledger accounts without any adjustments are used in the preparation of financial statements.

This type of trial balance is issued by accounting software packages. It is often manually compiled. An unadjusted trial balance is only used in double-entry bookkeeping, where there is a credit to every debit and all the entries are balanced. If an entity is following a single-entry system, it is not possible to create a trial balance with equal debit and credit.

Adjusted vs Unadjusted Trial Balance

A small table showing the differences between the two.

| Basis | Adjusted trial balance | Unadjusted trial balance |

| Meaning | An adjusted trial balance is one that is made after making all the necessary adjusting entries to the general balances of the ledger accounts. | An unadjusted trial balance is one that records the general balances of ledger accounts as it is without making any adjusting entries to them. |

| Adjusting entries | All the adjusting entries are recorded and only after that this type of trial balance is made. | No adjusting entries are recorded in this type of trial balance. |

| Additional account of net loss or net income | An adjusted trial balance shows an additional account of the net loss or net income of the firm. | Unadjusted trial balance on the other hand does not show any additional account for net loss or net income. |

| True and fair presentation | An adjusted trial balance shows the true and fair presentation of all the balances of the ledger accounts as all the required adjustments are made. | An unadjusted trial balance in comparison to an adjusted trial balance does not show a true and fair presentation of the accounts as no adjusting entries are made to this. |

| Type of bookkeeping | This type of trial balance can be used by both types of bookkeeping, that is, double-entry bookkeeping as well as single-entry systems. | This type of trial balance can only be used by double-entry bookkeeping systems. Firms maintaining accounts on single-entry systems cannot use this trial balance. |