Contra Liability

A liability account would usually contain credit balance however at times to offset a liability a separate account is used which contains debit balance and is paired along with it, this account is called a contra liability account. Seldom used in practice a contra liability account is used for book value adjustments related to an asset or a liability.

When an entry is recorded in this account the usual rules of entry are reversed adding a debit entry to the contra account. If there is no offset required against a related liability a contra account might have zero balance. Journal entry item related to contra liability account can possibly be identified with the often used word “discount”.

Examples of Contra Liability Account

Bond Discount Account

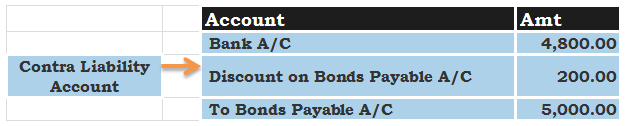

Journal entry for a bond worth 5000 being sold at 4800 (200 discount) would be captured as:

In the above journal entry “Discount on bonds payable account” offsets the “Bonds payable account”, this can be identified since both of them are oppositely treated i.e. debited and credited respectively.

To find out the current actual value of bonds payable the accountant would have to reduce the debit balance inside the contra liability account from credit balance of the particular liability account.

Value of Bonds = Credit Balance of Bonds Payable – Debit Balance of Discount on Bonds Payable

Gain on Reduction Account

If a borrower is having problems in paying back his loan amount, the lender would want to get whatever amount they can from the borrower for which they might mutually consider a negotiated reduced amount.

Though it is seldom used, however, in case if the amount payable is adjusted through negotiations gain on reduction account is used to offset the remaining amount in loan payable account which ultimately reduces the total obligations of a company.

Most often in such situations the amount of loan payable is reduced directly from loan payable account & a profit is shown on the Income statement of the business.

>Read Types of Liabilities