Meaning

Days sales outstanding or DSO is also known as days receivables, it measures the average number of days that a company takes to collect the payment after a credit sale has been recorded.

It is used for the estimation of the average collection period and helps to determine the efficiency with which the company’s accounts receivables are being managed.

Days sales outstanding or DSO is usually a monthly activity and it may fluctuate every month. This can be due to multiple business scenarios such as seasonality, change in business policies, economics, etc. It is useful to determine the liquidity, however, it is not one of the most accurate indicators.

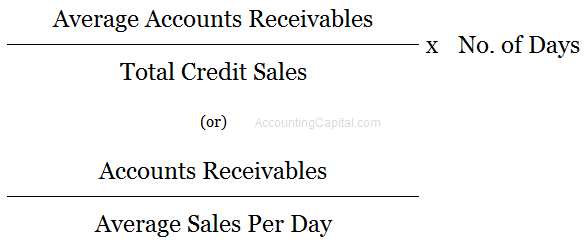

Formula to Calculate Days Sales Outstanding (DSO)

HIGH DSO – The company is lenient with its credit terms and allows more days for its customers to pay for sales. It may also indicate;

- Company’s customers have difficulty with repayment.

- Inefficient collection exercises by the company.

LOW DSO – The company has strict control over its credit terms and takes fewer days to collect its receivables.

Related Topic – What are Different types of Purchase Orders?

Example

Below are the details of a trading business.

| Average AR for April | 60,000 |

| Net credit sales for April | 3,00,000 |

| No. of days in the month | 30 |

| DSO | (60,000/3,00,000)*30 |

Days Sales Outstanding = 6 Days

It means the number of days on average that customers take to pay back to this company are 6 days.

Short Quiz for Self-Evaluation

>Read Days Payable Outstanding