-This question was submitted by a user and answered by a volunteer of our choice.

No, Prepaid Expense is Not a Fictitious Asset.

Meaning of Prepaid Expense

A prepaid expense is an expense incurred by an entity in advance before receiving such goods or services. The payment pertains to the future reporting period and is recorded as an asset. The payment made earlier shall be treated as an expense in the year of receipt of goods or services. The asset recorded earlier shall be written off proportionately to the expense accrued.

Meaning of Fictitious Asset

Fictitious means “Fake” or “Untrue” and Asset means anything that gets an economic benefit or adds value to the organization. A fictitious asset is not an actual asset as it does not have a monetary value. In other words, it cannot be realized.

Prepaid assets aren’t fictitious assets

Prepaid expenses and fictitious assets are both of a revenue nature. Prepaid expenses are expenses incurred in advance. Since the expense has not yet become due it is recorded as an asset. If such expense becomes due in the next reporting period it shall be treated as a current asset otherwise a non-current asset when not paid on time.

For Example,

Amit had a showroom on a rental basis and was supposed to pay an amount of 10,000 each month as a rental expense. Amit had a surplus fund and hence, had paid 2 months advance rent concerning the next reporting period.

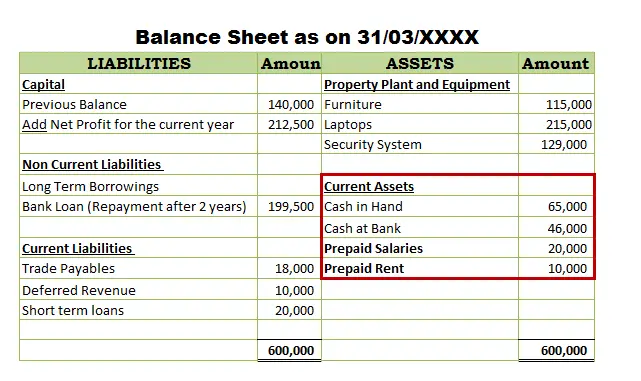

The amount of 20,000 paid shall be treated as a prepaid expense in the current reporting period and presented as a current asset in the balance sheet and the next reporting period at the end of each month, it shall be written off and treated as an expense in the income statement.

Fictitious assets are spread over more than one reporting period and hence are recorded as non-current assets but these are not actual assets so they are treated as fictitious assets. They may or may not provide any future benefit.

Journal Entry

Preliminary expenses are fictitious assets since these are already incurred but are spread over more than one reporting period and they do not provide any future benefit.

The Accounting Treatment of Prepaid Expenses as per modern rules of accounting will be:

At the time of incurring the expense the journal entry will be

| Particulars | Debit | Credit | Rules |

| Prepaid Expenses A/c | Amt | Dr increase in asset | |

| To Cash A/c | Amt | Cr decrease in asset |

Prepaid expenses are debited since they increase the value of the current asset as it will be paid in the future. This benefits the company. The cash account is credited as it is an expenditure and reduces the value of the asset.

At the time such expense becomes due

| Particulars | Debit | Credit | Rules |

| Expenses A/c | Amt | Dr the increase in expenses | |

| To prepaid expenses A/c | Amt | Cr the decrease in assets. |

The expenses account has been debited since it is being used from the prepaid expenses for the month. The prepaid expenses are credited since their value is slowly decreasing.

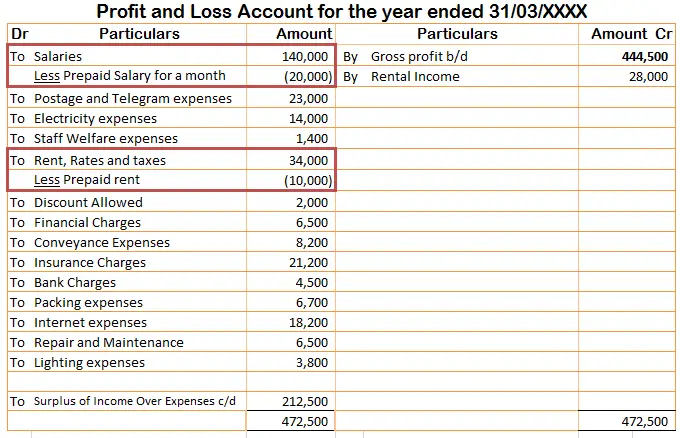

The prepaid expenses are reduced from the expenses in the profit and loss account as it is being utilized during the operating year and it slowly reduces the value of the current asset.

The prepaid expenses are reduced from the expenses in the profit and loss account as it is being utilized during the operating year and it slowly reduces the value of the current asset.

The prepaid expenses are shown under the current assets on the asset side of the balance sheet since they will be used within the operating period.

>Related Long Quiz for Practice Quiz 30 – Fictitious Assets

>Related Long Quiz for Practice Quiz 36 – Prepaid Expenses