Prepaid rent includes the word rent. Therefore, one might think that it is an expense, right? But, Prepaid rent is a current asset and not an expense. Let us break it down for you.

What are Current Assets?

Current assets are the assets that a business owns and expects to realize within 12 months or the operating cycle. Some examples of current assets are Bills Receivables, Cash, Cash at Bank, Inventories, etc.

What are Prepaid Expenses?

You can think of prepaid expenses as the costs that have been paid but are yet to be utilized. For example, prepaid rent, prepaid insurance, prepaid salaries, etc.

In the balance sheet, all the prepaid expenses that have not yet been consumed are recorded as current assets.

Accrual Vs Cash Basis

In the accrual basis of accounting, the expenses and revenues are recorded in the books when they are incurred or earned irrespective of the cash has been paid or received.

When you make the payment of rent before its due date, it is known as prepaid rent. Rent is usually paid in advance for multiple reasons, such as availing a discount, the landlord demanding a prepayment, etc. For a better understanding of the concept, let us have a look at the example given below.

Example of Prepaid Rent

Company X signs an agreement to rent a warehouse for 1,000 per month from March for 7 months. The landlord demands payment of the total amount in February. The journal entries to be recorded are as follows:

| Feb | Prepaid Rent A/c | Debit | 7,000 | Debit the increase in asset |

| To Cash A/c | Credit | 7,000 | Credit the decrease in asset |

(Being rent paid before the due date)

| March | Rent A/c | Debit | 1,000 | Debit the increase in expense |

| To Prepaid Rent A/c | Credit | 1,000 | Credit the decrease in asset |

(Being prepaid rent adjusted as it expires)

Note: The total amount of rent 7,000 (1,000 x 7) is initially recorded in the balance sheet under current assets as prepaid rent. The reason for recording it as a current asset is that the rent which will be due at the end of each month is already paid for and the benefit is yet to be availed.

Each month the prepaid rent account is reduced by the amount of rent paid for that month. The prepaid rent (asset account) will be reduced by 1,000 (7,000/7) each month and the amount shall be debited to rent (expense account) for each month.

Prepaid Rent Expense or Asset?

Prepaid rent is recorded under current assets in the balance sheet because businesses often pay the rent before the due date, and it is utilized within a few months of its payment, usually within the same financial period. The benefits of the payment in advance are realised later on.

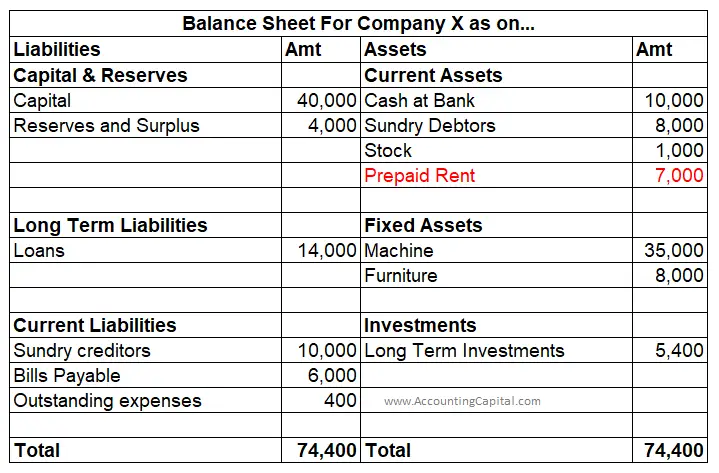

Prepaid Rent Shown in the Balance Sheet

In the Balance Sheet, the Prepaid expense is shown as a Current Asset under the Assets head of the Balance Sheet.

Conclusion

The key takeaways from the above article are:

- Prepaid rent is a current asset and not an expense.

- Prepaid expenses are the costs that have been paid but are yet to be utilized.

- Prepaid rent is recorded under current assets in the balance sheet.

>Related Long Quiz for Practice Quiz 20 – Current Assets

>Related Long Quiz for Practice Quiz 36 – Prepaid Expenses

>Read