Net Profit Ratio

Also known as Net Profit Margin ratio, it establishes a relationship between net profit earned and net revenue generated from operations (net sales). Net profit ratio is a profitability ratio which is expressed as a percentage hence it is multiplied by 100.

Net sales include both Cash and Credit Sales, on the other hand, net profit is the net operating profit i.e. the net profit before interest and taxes. Net profit ratio helps to find out net profit earned in comparison to revenue earned from operations.

NP ratio helps to determine the overall efficiency of the business’ operations, furthermore, it is an indicator of how well a company’s trading activities are performing.

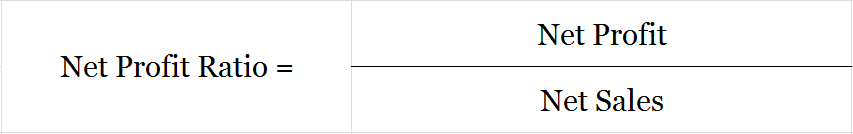

Formula to Calculate Net Profit Ratio

Note – It is represented as a percentage so it is multiplied by 100.

Net Profit = Operating Income – (Direct Costs + Indirect Costs)

Net Sales = (Cash Sales + Credit Sales) – Sales Returns

*Non operating incomes and expenses are not considered for calculation.

Example

Ques. Calculate NP Ratio from the below information

| Sales | 7,00,000 |

| Sales Returns | 1,00,000 |

| Direct Costs | 2,00,000 |

| Indirect Costs | 1,50,000 |

Net Profit Ratio = (Net Profit/Net Sales)*100

Net Sales = Sales – Returns

7,00,000 – 1,00,000

= 6,00,000

Net Profit = Operating Income – (Direct Costs + Indirect Costs)

*Considering income was only earned via sales and no other misc fee etc. were recevied.

6,00,000 – (2,00,000 + 1,50,000)

= 3,00,000

NP Ratio = (3,00,000/6,00,000)*100

= 50%

This means that for every 1 unit of net sales the company earns 50% as net profit. Alternatively, the company has a net profit margin of 50%, i.e. 0.50 unit of Net Profit for every 1 unit of revenue generated from operations.

High and Low Net Profit Ratio

This ratio is the main indicator of a firm’s profitability, a trend analysis is usually done between two different accounting periods to assess improvement or deterioration of operations.

High – A high ratio may indicate low direct and indirect costs which will result in a higher net profit of the organization.

Low – A low ratio may indicate unnecessarily high direct and indirect costs which will result in a lower net profit of the organization, thus reducing the numerator to lower than the desired number.

Short Quiz for Self-Evaluation

>Read Gross Profit Ratio