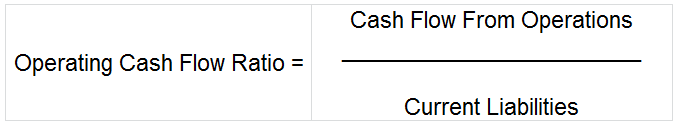

Operating Cash Flow Ratio

Operating cash flow ratio also known as cash flow from operations ratio is calculated by dividing cash flow from operations by current liabilities. All cash generated from firm’s core business operations is termed as operating cash.

It is different from cash generated through investing and financing in a way that it doesn’t take into account any extra cash generated apart from a business’ core operations. This ratio determines a firm’s liquidity by evaluating its operating cash with respect to its current liabilities.

Inside a cash flow statement, non-cash charges are adjusted from a business’ net income which then increases or decreases the working capital. This adjustment results in the final operating cash flow of a company.

Formula to Calculate Operating Cash Flow Ratio

Cash Flow From Operations: Revenue from operations + Non-cash based expenses – Non-cash based revenue

Current Liabilities: It includes Creditors, B/P, Accrued Expenses, Provisions, Short-Term Loans etc.

Example of Operating Cash Flow Ratio

From the below details of Unreal corporation calculate their operating cash flow ratio for the quarter ending 30th June 2018

| Net Cash Flow From Operations | Current Liabilities | |

| Q2 2018 | 200,000 | 150,000 |

| Operating Cash Flow Ratio Q2 2018 | 1.33 |

Cash flow from operations ratio of 1.33 shows that for every unit of current liability the company had 1.33 units of cash flow from operations during the second quarter of 2018.

High & Low Operating Cash Flow Ratio

High cash flow from operations ratio indicates better liquidity position of the firm. There is no standard guideline for operating cash flow ratio, it is always good to cover 100% of firm’s current liabilities with cash generated from operations. So a ratio of 1 & above is within the desirable range.

Low cash flow from operations ratio i.e. below 1 indicates that firm’s current liabilities are not covered by the cash generated from its operations. This is not a desirable state for a business and shows a stressed liquidity position.

Short Quiz for Self-Evaluation

>Read What is Super Quick Ratio?