Introduction

In the diverse world of investments, debentures enable investors to balance their portfolios with stable and predictable returns. Unlike equities that are subject to fluctuating share market timings, debentures offer a fixed income, making them an attractive option for those seeking financial security. This article explores the reasons behind the inclination of pro-investors towards debentures in the Indian securities market.

The allure of fixed-income

One of the primary reasons pro-investors gravitate towards debentures is the promise of a fixed income. Debentures, being debt instruments, provide investors with regular interest payments at a predetermined rate, which is not influenced by the volatile share market timings. This predictability allows investors to plan their financial strategies with a higher degree of certainty, ensuring a steady income stream regardless of market fluctuations.

Diversification and risk management

Debentures play a crucial role in diversification; a strategy pro investors use to spread their investment across different asset classes to mitigate risk. By incorporating debentures into their portfolio, investors can offset the unpredictability associated with equities and commodities. This balanced approach to investing, taking into account share market timings, helps in reducing the overall risk, making debentures an essential component of a well-rounded investment portfolio.

Security and seniority in repayment

Another appealing aspect of debentures is the security they offer. In the event of a company’s liquidation, debenture holders are given priority over equity shareholders when it comes to repayment. This level of security is particularly attractive to professional investors who are cautious about the potential risks involved in the share market. The seniority of debentures in the repayment hierarchy adds an extra layer of protection for investors, ensuring their capital is safeguarded to a greater extent.

Tax efficiency

Investing in debentures can also be tax-efficient, depending on the structure of the investment and prevailing tax laws. The interest earned on debentures is taxed at a lower rate compared to dividends from shares, offering a tax advantage to investors who are in higher tax brackets. This tax efficiency, coupled with the fixed income and security offered by debentures, makes them a compelling choice for pro-investors looking to optimise their post-tax returns.

Marketability and liquidity

Debentures issued by reputed companies often come with high marketability, making them easily tradable in the securities market. This liquidity is particularly beneficial for investors who might need to liquidate their holdings due to unforeseen circumstances. Unlike certain assets that might require waiting for favourable share market timings, debentures can typically be sold with relative ease, providing investors with quick access to their capital.

Shares vs. Debentures

While both shares and debentures are investment instruments, they differ significantly in terms of their characteristics and risk-return profiles. Shares represent ownership in a company, entitling shareholders to a portion of the company’s profits and voting rights. On the other hand, debentures are debt instruments where investors lend money to the issuing company in exchange for regular interest payments and eventual repayment of the principal amount.

Opening a demat and trading account allows investors to buy and sell shares of publicly listed companies, providing opportunities for capital appreciation and dividends. Unlike debentures, which offer fixed income, shares offer the potential for higher returns through capital gains as the share prices fluctuate based on market dynamics.

Conclusion

Debentures present a lucrative option for pro investors, offering a blend of fixed income, security, tax efficiency, and liquidity. By understanding the role debentures can play in a diversified portfolio, investors can make informed decisions, leveraging these instruments to mitigate risk and enhance returns.

Take the next step with BFSL:

Do not miss the opportunities the stock market presents. Open your Demat and trading account with Bajaj Financial Securities Limited today. Happy investing!

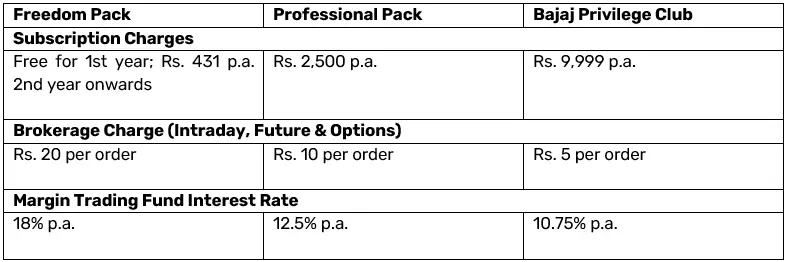

BFSL subscription plans

Enjoy lower brokerage and MTF rates with premium subscriptions.