Income Statement vs Balance Sheet

An Income statement and a Balance sheet are two significant financial statements in accounting, and both statements have their own individual purpose and identity. They are important, yet very different. Below, you will find few points showing the difference between the income statement and balance sheet.

Income Statement (Profit and Loss Account)

1. The income statement is an important final account of a business that shows the summarized view of revenues and expenses of a particular accounting period.

2. An income statement is prepared for an entire accounting period.

3. All income and expense accounts are closed and not carried forward.

4. An income statement shows how profits/gains are earned and expenses/losses are incurred.

5. It consists of income and expenses.

6. The balance of an account is transferred to the capital account in the balance sheet.

Related Article – Difference between Trial Balance and Balance Sheet

Balance Sheet

1. The balance sheet is a statement that shows a detailed listing of assets, liabilities, and capital showing the financial condition of a company on a given date.

2. A balance sheet is prepared on the last day of the accounting period.

3. All asset and liability accounts are left open and carried forward to the next period.

4. Balance sheet, on the other hand, shows the financial position of a business.

5. It consists of assets, liabilities, and capital.

6. The balance derived from a balance sheet is transferred to the capital account.

7. The balance of the statement becomes the opening balance for the next period.

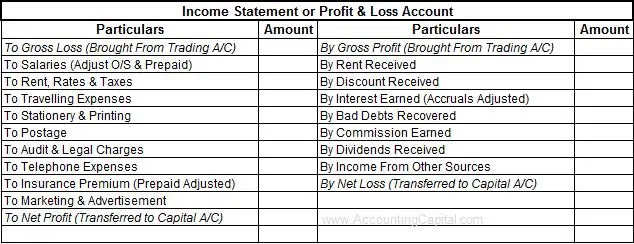

Example of Income Statement (Profit and Loss Account)

The income statement is prepared to determine the profit earned or loss sustained by the business enterprise during a period of time. As a custom in practice, profit is ascertained in three stages,

- Ascertainment of gross profit

- Calculation of operating profit

- Ascertainment of net profit

The above three figures can be determined by analyzing the income statement.

Following is the income statement of ABC Ltd for the year ending 31st March, YYYY,

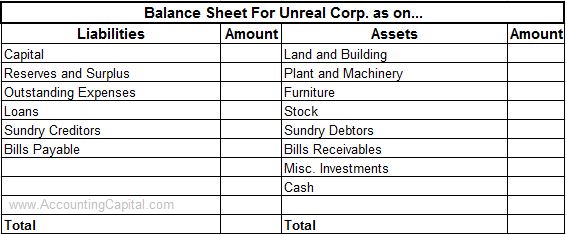

Example of Balance Sheet

In order to know the position of assets and liabilities of the business, a statement is prepared which is called the Balance sheet. It is a summary of the complete accountancy records. The balance sheet represents the financial position of a business on a specific day.

Following is the Balance sheet of Unreal Corp. on 31st March, YYYY,

What comes first and should they match?

What comes first?

The income statement and the balance sheet are both parts of the accounting cycle. The cycle starts with identifying the economic transaction and recording them and then ends with the analysis of financial statements. The financial statements consist of the income statement and the balance sheet. It is a custom as well as practical to prepare the income statement before preparing the balance sheet,

- The income statement provides required inputs for the preparation of the balance sheet and the statement of retained earnings.

- The first critical piece of information for the users of accounting information is generally the net profit/loss, salary figures, amount of sales turnover, etc.

Should they match?

Another important observation is that the balance of the income statement and the balance sheet should not and will probably not match. The income statement balancing figure is either the net profit or the net loss. On the other hand, if the balance sheet is accurately prepared, the assets total will match the liabilities total.

- The income statement contains all the revenue and expenditure figures of the business. These items are of recurring nature and relate to the current year while the balance sheet items are of a fixed nature. Both these statements use different items from the trial balance.

- The income statement provides the net profit/loss figure for the statement of retained earnings. Retained earnings will then form part of ‘reserves and surplus’ in the balance sheet. Hence, the balance sheet will on one hand rely on the income statement for a lot of critical inputs. On the other hand, it will show the observable position of assets and liabilities with the business, that is completely unrelated to the income statement.

Therefore, these statements are very much linked and interdependent. But, they do not match.

Short Quiz for Self-Evaluation

>Read Balance Sheet Accounts