-This question was submitted by a user and answered by a volunteer of our choice.

What is Rent Received in Advance?

Rent Received in Advance is an amount received by the landlord from the tenant before the actual due date. It’s an income received in advance.

Income received in advance refers to the amount received by a person or an entity before rendering services or transfer of title to goods.

Rent received in advance is typically recorded on the landlord’s balance sheet as a liability until it is earned, at which point it is recognized as rental income on the income statement.

It’s important for landlords to accurately track and manage rent received in advance to ensure proper financial reporting and compliance with accounting standards.

For Example,

A landlord may have the policy to charge the last month’s rent in advance for his convenience to cover himself from loss of income on the expiry of the lease term. A lot of landlords across the globe follow this policy.

Whether it is Taxable?

The answer to this question is that it depends. It depends on the accounting policy an entity or a person follows.

If a person follows the accrual system of accounting then the rent received in advance shall be treated as a liability in the year of receipt and it will be taxable in the year of realization.

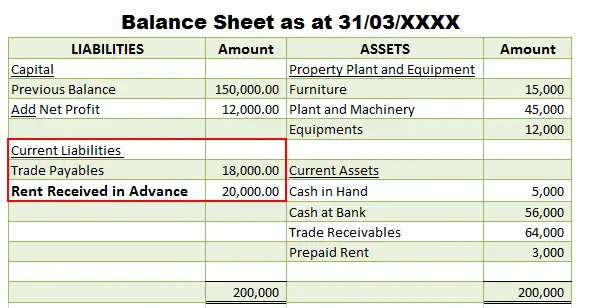

The image shown below is the perfect example of the same:

However, If a person follows the Cash System of Accounting then such rent received shall be treated as an income in the year of receipt and it would be taxable in the year of receipt itself.

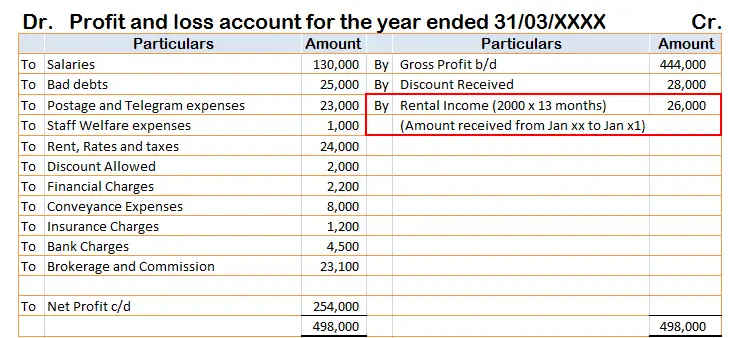

The image shown below explains the same:

The accounting treatment in each of the cases shall be:

In the Accrual System of Accounting

| Cash A/c Dr. | Asset | Debit the increase in an asset. |

| To Rent Received in Advance A/c | Liability | Credit the increase in liability. |

In the above journal entry, it is reflected that rent will not be recorded in the income statement that is it will be taxable in the year of accrual and so it shall be the taxable income in the next accounting period.

In Cash System of Accounting

| Cash A/c Dr. | Asset | Debit the increase in an asset. |

| To Advance Rent Income A/c | Income | Credit the increase in income. |

In this case, it is reflected from the above journal entry since the cash system is followed the rent is recorded as an income and since it will be reflected in an income statement it is a taxable income in the year of receipt.

>Related Long Quiz for Practice Quiz 31 – Income received in Advance