-This question was submitted by a user and answered by a volunteer of our choice.

Meaning of “Income received in advance“

Income received in advance refers to an income that has been received by the entity in the current accounting period but it actually relates to the future accounting period. The entity has just received the income but has not earned it yet. It is also known as Unearned Income.

The entity receiving the income in advance still has an obligation to render the goods or services in the next accounting period, corresponding to the income received. Only after the entity renders the goods or service, the transaction will be considered complete. So, because of this reason, income received in advance is certainly considered to be a liability.

As per the accrual system of accounting and to present the true and fair financial position of the entity, income received is to be recorded in the books of accounts, irrespective of when the actual goods or services are provided. So, income received in advance is recorded as a liability in the current accounting period.

Income received in advance includes

- Rent received in advance

- The commission received in advance

- Professional fees received in advance

- The premium received in advance, etc.

From the meaning of the word “Income received in advance” itself, we can conclude that it is a liability and not an asset.

Treatment in Financial Statements

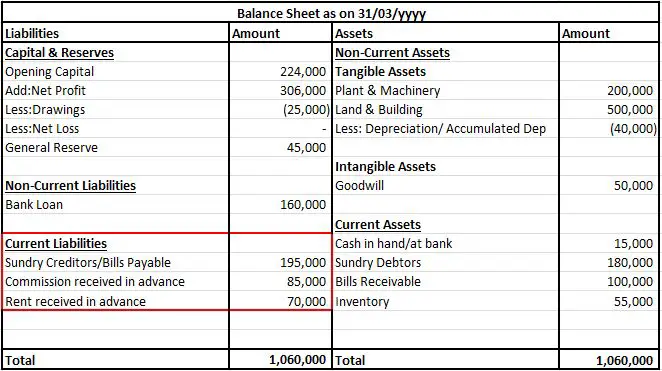

Income received in advance is shown in both the Balance Sheet and Profit and Loss account.

| Financial Statement | Treatment |

| Profit and Loss account | Reduced from the respective income on the credit side of profit and loss account |

| Balance Sheet | Presented as a liability in the balance sheet under the head “Current Liabilities” |

A snippet of the balance sheet has been attached to show the presentation of income received in advance.

Conclusion

Income received in advance is a liability and not an asset.

>Related Long Quiz for Practice Quiz 31 – Income received in Advance