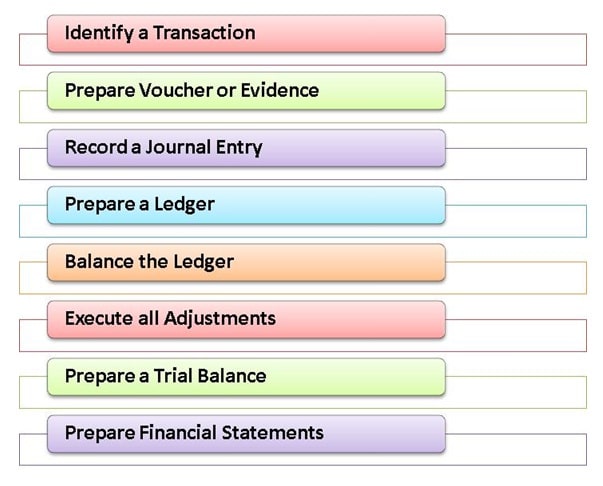

Accounting Cycle or Accounting Trail

The accounting cycle is a chronological order in which an accounting process flows. It is a step by step process followed to achieve the ultimate goals of accounting.

Firstly, the information is recorded in a book or accounting software (in the modern scenario) called a Journal. Then it is adjusted and moved to a ledger. Ledger balances are then summarized to make a trial balance. Finally, from trial balance financial statements such as an income statement, a trading account, and a balance sheet are prepared.

Accounting Cycle Steps

- Identification – This is the origin of the accounting cycle. This step means identifying events that are to be recorded. It involves observing activities and selecting those events that are – considered to be evidence of economic activity and are relevant to the business organization. So, Events that are relevant and can be quantified in monetary terms are considered for the recording.

- Prepare Evidence – When a financial transaction occurs, it gives rise to a source document. This supply document is proof that describes all the fundamental facts of the transaction in question, as the amount, which parties are involved, the aim of the transaction, and the transaction date. Thus, documents such as; a receipt, an invoice, a depreciation schedule, and a bank statement, a debit note, a credit note, etc. produce proof that an economic event has actually occurred.

- Record a Journal Entry – Once the economic events are identified and quantified, this step involves recording transactions in chronological order and a systematic manner. According to double-entry accounting, each transaction should be recorded as both a credit and debit in separate journals. Sometimes, transactions are recorded in the books of original entries also.

- Prepare a Ledger – Ledger accounts keep track of a company’s entire financial activity. Record of the journal and other subsidiary books is input for the ledger. Under this step, posting is done in the ledger in various accounts, on the basis of Journal entries.

- Balance the Ledger – Each account like cash, accounts payable, investments, inventory, etc are balanced at the end of a certain period. If the total of the debit side is more than that of the credit side, the balance is called Debit Balance and is written on the credit side. In the same way, when the total of the credit side of an account is more than that of the debit side total, the balance is called Credit Balance. The difference amount is written on the debit side of the account. So, these balances are the output of this step.

- Execute Adjustments – At the end of the period, adjustments are made. These are the result of rectifications made in the books of accounts and the results from the passage of time. For example, an adjusting entry may include advance payment of rent or insurance. So, this step requires the usage of the matching principle to organize company transactions into the appropriate financial periods.

- Prepare Trial Balance – Balances from the ledger are brought to the trial balance. This is done so that any mathematical errors that may have occurred during the initial stages of the accounting cycle, can be identified. A trial balance matches if the total of debit is equivalent to the total of credit for the business.

- Prepare Financial Statements – The last step of the Accounting cycle allows the organization of relevant financial data into appropriate categories in the financial statements of the business. Record of the trial balance is the input for this step. It involves summarizing transactions into Trading Account, Profit & Loss Account, and Balance sheet based on their nature.

Example of Accounting Cycle

PepsiCo bought a new processing plant for 10 Million, which was shown on the balance sheet as an asset. We will study the possible accounting trail related to this transaction.

| Step 1 | Transaction for buying the building is identified.

Analysis – Buying a new plant is both relevant for the business and can be quantified in monetary value. So, this is an economic activity. |

| Step 2 | Evidence such as a legal ownership document is prepared.

Analysis – The ownership deed is the source document that will be evidence for the above financial transaction. It will disclose the parties involved, amount and time of transfer of payment, etc. |

| Step 3 | Journal entry to purchase the building is recorded in books.

Analysis – A Journal entry to record the transaction will be passed. PepsiCo now has more plant than before. The plant is an asset, which is increasing on the debit side for 10 million. If a Bank transfer is done to pay for it, the bank balance is an asset, decreasing on the credit side. |

| Step 4 | A ledger account such as a “Plant & Equipment account” is created.

Analysis – PepsiCo will go through each transaction and transfer the account information into the debit or credit side of that ledger account being affected. In the Plant & Equipment Account, there will be a debit of Bank by 10 million. |

| Step 5 | Ledger account for the Plant & Equipment is then balanced.

Analysis – If there are no further transactions, the Ledger account is balanced and shows a debit balance. |

| Step 6 | All adjustments, if any, are incorporated.

Analysis – If there is a requirement for rectifications, adjustment entries will be passed. |

| Step 7 | The amount is treated as an asset and moved to trial balance.

Analysis – The balance of the Ledger account is the nature and output for the Trial Balance. The plant is treated as an asset and the ledger balance is its historical value. |

| Step 8 | The amount is then shown on the asset side of the balance sheet.

Analysis – Since the above transaction involves two assets (Plant & Bank balance) only, it will reflect in the balance sheet. The Balance sheet will show an enhanced value of plant and reduced value of bank balance by 10 million. |

Short Quiz for Self-Evaluation

>Related Long Quiz for Practice Quiz 11 – Accounting Cycle

>Read What is Journal Posting?