Voucher

A document that serves as evidence for a business transaction is called a Voucher. Sometimes, mistakenly seen as just a bill or receipt; it can have many other forms.

It is not the appearance of it that matters it just needs to act as evidence of a transaction. When a transaction is entered, the evidence of that transaction is also confirmed. A voucher helps in recording expenses or liability and further helps in its payment.

They are also called source documents as they help in identifying the source of a transaction. A few examples of vouchers include bill receipts, cash memos, pay-in-slips, checks, an invoice, a debit or credit note.

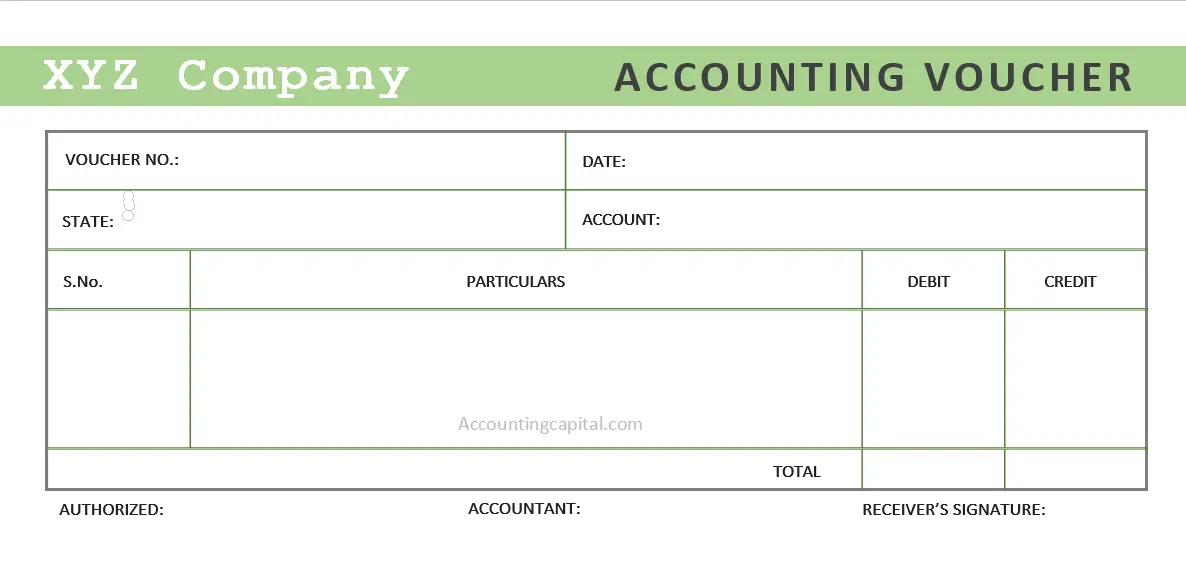

Format and Template of Voucher (Invoice)

Related Topic – What is a Promissory Note?

Different Types of Vouchers

- Source Vouchers

- Accounting Vouchers

Source Vouchers

Documents which are created at the time when a business enters into a transaction are called source vouchers, for example, rent receipts, bill receipts at the time of cash sales, etc.

They are expected to contain complete details of a transaction duly signed by the maker and act as evidence of the transaction.

Accounting Vouchers

This type of a voucher basically analyzes a business transaction from the accounting standpoint and is used for recording purposes.

These are commonly prepared by accountants on the basis of supporting vouchers and approved by a different individual. They are further subdivided into two, cash and non-cash vouchers.

Examples of cash type

- Credit vouchers

- Debit vouchers

Examples of the non-cash type

Short Quiz for Self-Evaluation

>Read Difference between Debit Note and Credit Note