Debit Note

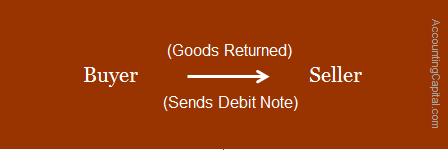

A debit note also known as a debit memo is a document sent by the seller to the buyer informing about the current debt obligations or it may be a document sent by the buyer to the seller at the time of returning goods as proof (return outwards).

Depending on the purpose of the debit note, it can provide information regarding a forthcoming invoice or serve as a reminder for payments that are due. It is often used in b2b (business-to-business transactions).

In some cases, a seller may issue a debit memo when the full amount was not charged, i.e. the invoice amount was incorrect.

In the case of a buyer, it reduces the amount due to be paid back to the seller if the amount due is nil then it allows further purchases on behalf of that. The intent is to notify the seller that they’ve been debited against the goods returned.

A debit note is issued for the value of the goods returned. In some cases, sellers may send debit notes which look like an invoice, however, they are different as debit notes are not required to be paid immediately.

Example of Debit Note

Sent by the seller,

Companies X & Y have a seller and buyer relationship and the seller (X) sent a debit note for 50,000 informing Y about the current obligation due.

Sent by the buyer,

Company-A purchases goods worth 1,00,000 from Amazon in a (business-to-business) transaction, however, 10,000 worth of goods were found damaged due to some reason & this was notified to Amazon at the time of actual delivery.

Company-A (buyer) issues a debit note for 10,000 in the name of Amazon (seller). This reduces the obligation of the buyer by 10,000 and is now only required to pay 90,000.

Few Characteristics of a Debit Note

- It is usually a document sent by the seller to the buyer informing about the current debt obligations

2. It may also be sent by a buyer to inform about the debit made on the account of the seller along with the reasons.

3. The purchase returns book is updated on its basis. (In case of return of goods)

4. It is prepared like a regular invoice and shows a positive amount but is not instantly due like an invoice.

Related Topic – Accounts Payable Process with Journal Entries

Journal Entry for Debit Note

In the books of buyer

Goods returned by the buyer are purchase return, and the impact of returning goods to the seller are;

- Current liability decreases as payables against credit purchases reduce.

- Expense decreases as credit purchases reduce.

| Creditor’s A/C | Debit |

| To Purchase Return A/C | Credit |

In the books of the seller

Goods received (back) by the seller are sales return, the impact of receiving goods by the seller are;

- Revenue decreases as credit sales reduce.

- Current assets decrease as receivables against credit sales reduce.

| Sales Return A/C | Debit |

| To Debtor’s A/C | Credit |

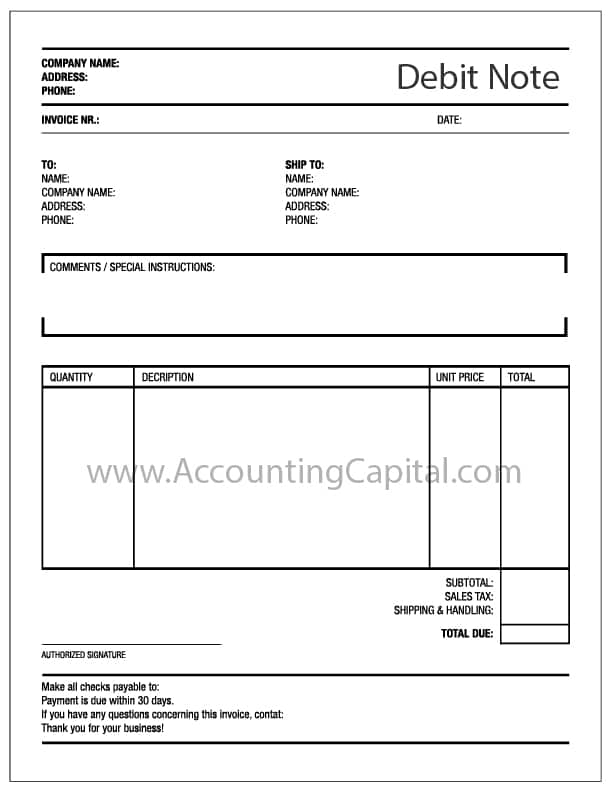

Sample Debit Note Template

Revision and Highlights

Highly Recommended!!

Do not miss our 1-minute revision video and the quiz below. This will help you quickly revise and memorize the topic forever. Try them :)

Short Quiz for Self-Evaluation

>Related Long Quiz for Practice Quiz 25 – Debit Note

>Read Credit Note