Reclass Entry

Accounting for business also means being responsible for adjustments and corrections. One such adjustment entry is ‘reclass’ or reclassification journal entry. The process of transferring an amount from one ledger account to another is termed as reclass entry.

It is most often seen as a transfer journal entry & is a critical part of the final accounts of a business.

Uses of this entry

- For correction of a mistake.

- For reclassification of a long-term asset as a current asset.

- For reclassification of a long-term liability as a current liability.

- To change the type & purpose of an asset in the financial statements.

Example – Reclass Entry

Though there are quite a few reasons to perform a reclass entry however we will illustrate one of the most common scenarios i.e. correction of a mistake.

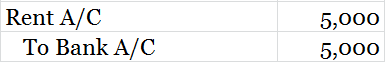

The finance department booked payment of Rent expenses for the current month using the below journal entry,

(Error journal entry)

The above entry was posted to Rent A/C in error as the original payment related to Telephone expenses.

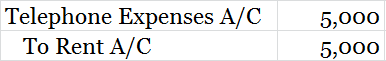

After finding the error a transfer entry was used to reclass the ledger amount of 5,000 in rent account to telephone expenses account.

(Correction reclass entry)

Debit – Debited telephone expenses account to increase expenses by 5,000 in its ledger balance.

Credit – Credited rent account to decrease rent expenses by 5,000 in its ledger balance.

Short Quiz for Self-Evaluation

>Read True-up Entry