True-up Entry Concept in Accounting

In its most generic form a true-up means to match, reconcile, tie-out two or more balances with the help of an adjustment. In accounting, this adjustment journal entry is called true-up entry.

There are many reasons why a mismatch may exist between two balances;

- Budgeting – Some recurring expenses are estimated at the beginning of the year and booked in each period accordingly. There is always a chance of going over or under the budget.

- Timing Differences – If a bill or invoice is not received till the end of an accounting period the expense is accrued as per estimate after the actual bill/invoice is received it is then matched with the help of a true-up entry.

- Errors & Omissions – With manual intervention, there is always a chance of human errors and misses.

- Quantification – Not every expense and situation can be quantified and anticipated in advance, for example, an increase in headcount resulting in an additional payment of insurance premium at the end of a year.

Example I – True-up Entry – Timing Difference

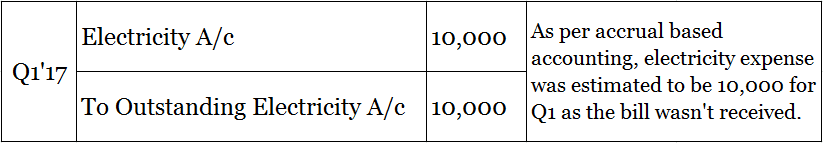

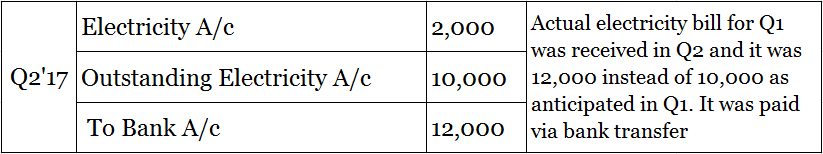

Unreal Corp. Pvt. Ltd. received their electricity bill for Q1’2017 in Q2’2017. The accountants pre-booked accrual for 10,000 as an anticipated expense in Q1’2017 however in Q2’2017 when the actual bill was received it was for 12,000 so a true-up entry was booked to raise the expenses by 2000.

Journal entry in Q1’2017 as per accrual of electricity expense to the amount of 10,000

As per the accrual-based accounting concept, it is required to anticipate and record all expenses even if the actual payment is not made in the same accounting period.

Journal entry in Q2 when the actual bill was received for 12,000 (bill for Q1)

Related Topic – What is a Contingent Liability?

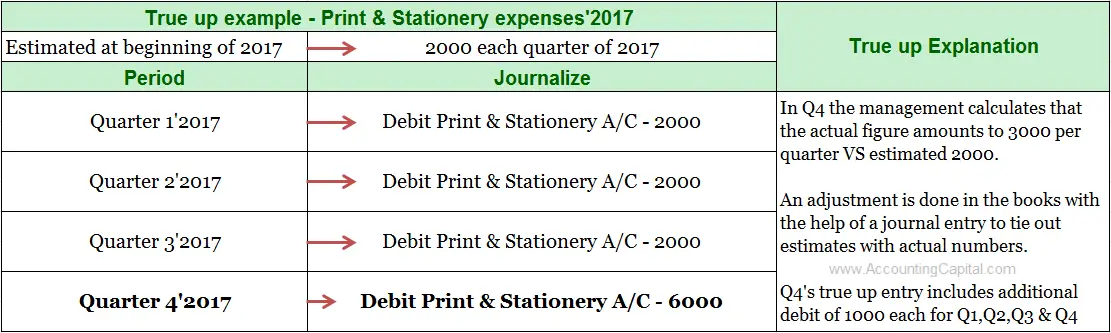

Example II – True-up Entry – Budgeting Differences

Estimated Print & Stationery cost at the beginning of 2017 = 2000/Quarter

Actual Print & Stationery cost determined in Q4’2017 = 3000/quarter

Adjusted amount entered to true-up the balances in Q4’2017 = 3000 + (1000×3 for previous quarters)

Short Quiz for Self-Evaluation

>Read Reclass Entry