Meaning and Definition

The income statement or Profit & Loss account is an essential financial statement that provides a summary of a firm’s expenses, losses, incomes, and gains for a specific accounting period.

The credit side (right) of a profit and loss account deals with income and gains, whereas the debit side (left) deals with expenses and losses. The difference between the two sides is written on the smaller side.

If we have a credit balance in the Profit and Loss account, it means the credit side is larger than the debit side. In short, if the Credit Total > Debit Total = Credit Balance. For the business, it means that the money we earned (credit) was more than the money we lost (debit).

The credit balance of a Profit and Loss Account means “Net Profit” for the business, whereas a debit balance of a profit and loss account indicates a net loss.

Example

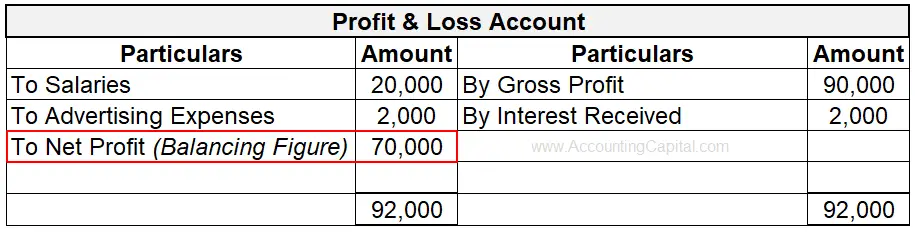

Following is the Profit and Loss account of PQR for the year ending Dec 20YY

In the above example, the debit total is 22,000, and the credit total is 92,000. The balance of 70,000 represents the balancing figure, which has been highlighted in red.

In the above example, the debit total is 22,000, and the credit total is 92,000. The balance of 70,000 represents the balancing figure, which has been highlighted in red.

The above example shows a credit balance in the Profit and Loss account. This simply means that the income generated by the firm is higher than the indirect expenses incurred.

70,000 will be added to the Capital A/C, thereby increasing the total capital invested in the business.

Related Topic – Meaning of Capitalized in Accounting

Credit Balance of Profit and Loss Account shown in the Balance Sheet

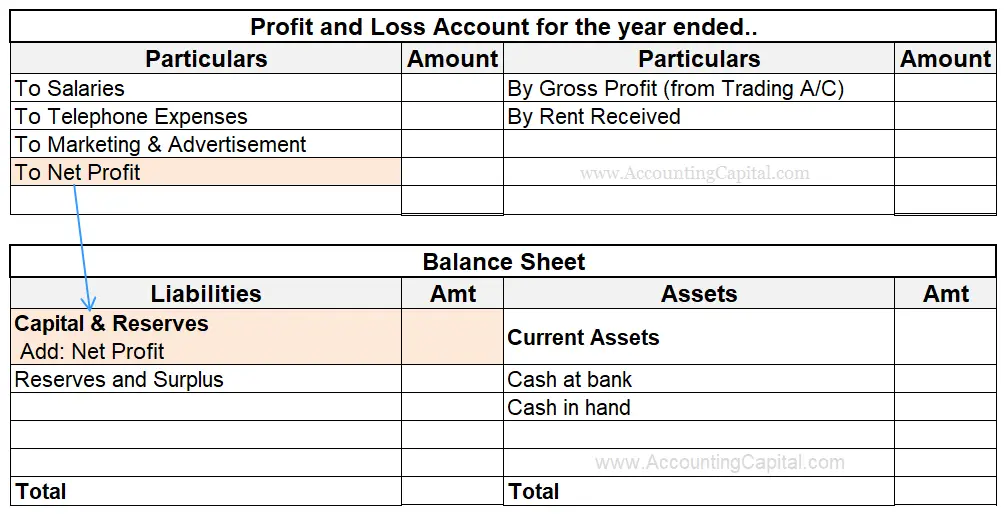

At the end of a financial year, the net profit is transferred to the balance sheet and shown as an addition to the Capital. This means that the company has made more money after covering its costs.

It is reflected as a positive amount. This addition in equity signifies that the company’s overall financial position has been positively impacted.

The image given below shows the transfer:

Net Loss

When the debit side of the Profit and Loss account is greater than the credit side, it is a debit balance. This debit balance is called Net Loss. It means that the indirect income of the business is less than the expenses. The net loss is subtracted from the capital.

Related Topic – Gross Profit and Gross Loss

Frequently Asked Questions Related to this Topic

Question – 1 – Select the most appropriate alternative from those given below:

The credit balance of the Profit and Loss Account means _____?

- Gross Loss

- Net Loss

- Net Profit

- Gross Profit

Answer – The answer is C. The reason is clearly explained in the above text in this article.

Question – 2 – What is the credit side of the profit and loss account?

Answer – The credit side of a profit and loss account shows a combination of Gross profit, Revenues from secondary activities, and Gains.

Question – 3 – The credit balance of the profit and loss account is shown on the _______.

A. “Assets” side of the balance sheet.

B. “Liability” side of the balance sheet.

C. not shown on the balance sheet.

D. half on the “Assets” side and half on the “Liabilities side.

The answer is B. Profits earned and losses incurred by a business are to be transferred to the owner(s). This is why it is added to the capital and adjusted accordingly.

Question – 4 – Profit and Loss Account is a _____ account?

- Personal

- Real

- Nominal

- Valuation

Answer – The answer is C. It is a nominal account prepared at the end of an accounting period.

Related Topic – Net Profit Ratio

Conclusion

- Both external and internal users of accounting information utilize an income statement to assess overall business performance and efficiency.

- An income statement with a credit balance indicates that the business is seeing a net profit.

- As a result of net profit, investors benefit from an increase in total capital.

>Read Debit Balance of Profit and Loss Account