Users of Accounting Information

Accounting is the language of business, it brings life to the otherwise lifeless business activities. It acts as a bridge between users of the information and the day to day transactions that occur inside a business. Users of accounting information may be inside or outside a business.

Qualitative characteristics of accounting information such as identifying, measuring, recording and classifying financial transactions help businesses with decision making, analysis, target setting, budgeting, pricing, forecasts, etc.

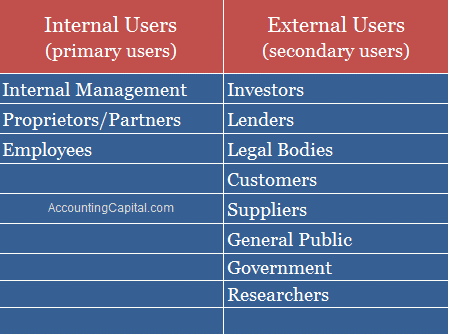

There are primarily two types of users of accounting information;

Internal users (primary users) – If a user of the information is part of the business itself then he/she is considered as one of the internal or primary users of accounting information.

For example, management, owners, employees, etc. The branch of accounting which deals with internal users is called management accounting.

External users (secondary users) – If a user of the information is an external party and is not related to the business then he/she is considered as one of the external or secondary users of accounting information.

For example, potential investors, lenders, vendors, customers, legal and tax authorities, etc.

Internal Users of Accounting Information – (Primary)

Following are the primary users of accounting information:

1. Management – Organization’s internal management includes all junior and senior business managers.

| They use it for |

| 1. Budgeting, forecasting, analysis & take important financial decisions. |

| 2. Investment decisions, identification of warning and opportunity signals. |

| 3. Taking informed & evaluated decisions. |

| 4. Compliance with all statutory, regulatory, and any other external body. |

2. Owners/Partners – Owners are the legal stakeholders of the business and the ultimate signing authority.

| They use it for |

| 1. Tracking their investment and monitoring their return on investment. |

| 2. Observing their capital invested and evaluating its upward or downward move. |

| 3. Keeping an eye on the overall well-being of the business. |

3. Employees – Full-time & part-time workers. They are essentially on the company’s payroll.

| They use it for |

| 1. Checking the overall financial health of the company as it affects their remuneration and job security. |

| 2. Decision making in case of shares based payment such as ESOPs offered by the employers. |

| 3. Examining if the employer is depositing all required funds to the appropriate authorities such as the provident fund, 401(k), etc. |

Related Topic – What is the Accounting Equation?

External Users of Accounting Information – (Secondary)

Following are the secondary users of accounting information:

1. Investors – They may be current investors, minority stakeholder, potential future investors, etc.

| They use it for |

| 1. Checking how the management is utilizing the equity invested in the business. |

| 2. Decisions related to an increase in investment or to divest from the business. |

| 3. Analyzing their present investment in the business or the overall financial health in case of a potential investor. |

2. Lenders – Banks and Non-banking financial companies which provide loans in the form of cash or credit are termed as lenders.

| They use it for |

| 1. Evaluation of short-term and long-term financial stability of a business. |

| 2. An insight into the liquidity, profitability, etc. with the help of ratio analysis |

| 3. Assessment of the creditworthiness with the help of financial ratios and scrutiny of the three main financial statements in accounting. |

3. Regulatory and Tax Authorities – Regulatory bodies such as the stock exchange & authorities include the govt. along with various statutory and tax departments.

| They use it for |

| 1. To keep a check and ensure that the firm is following all required accounting principles, standards, rules & regulations. |

| 2. The ultimate intent is to protect business integrity & safeguard investors. |

| 3. Tax department as one of the users of accounting information assures accurate tax calculation by the companies. |

4. Customers – Are buyers of goods or services and may exist at any stage of a business cycle. They may be producers, manufacturers, retailers, etc.

| They use it for |

| 1. Checking the continuous inflow of stock and the pace of overall production. |

| 2. Assessing the financial position of its suppliers which is essential to maintain a stable source of supply. |

5. Suppliers – Are the sellers of goods and services.

| They use it for |

| 1. Inspecting the credibility of their customers by evaluating their repayment ability. |

| 2. Setting up a credit limit & payment terms with their customers. |

6. Public – The general public is also among users of accounting information. They are keen to know the financial health of a business to get a fair idea of the firm’s niche market, business environment, and economic atmosphere of the country.

Short Quiz for Self-Evaluation

>Read What is Working Capital (with Formula)?