Preliminary expenses – Meaning

All expenses incurred before a company is formed i.e. cost incurred before the start of business operations is termed as preliminary expenses. They are a common example of fictitious assets and are written off every year from the profits earned by the business.

Examples of such expenses suffered before the incorporation of business are;

- Legal cost (Govt. & Court related fees)

- Professional fees (Lawyers, Chartered Accountants, etc.)

- Stamp duty

- Printing fees

Shown in Financial Statements

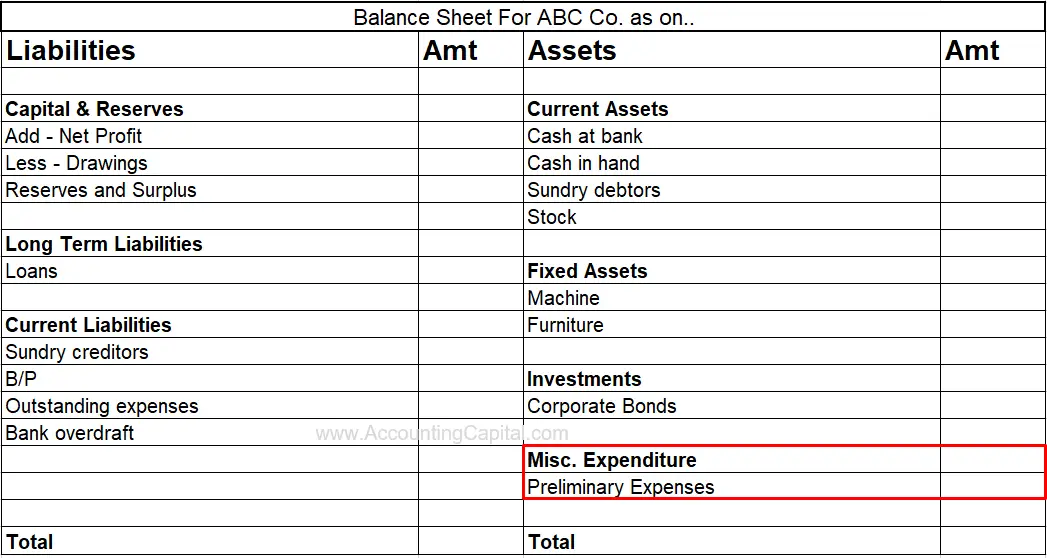

Also known as pre-operative expenses, preliminary expenses are shown on the asset side of a balance sheet.

The portion which is written off from the gross profit in the current year is shown on the income statement and the remaining balance is placed in the balance sheet. They are preferably written off within the same year (depending on amount & local accounting standards).

Related Topic – Difference Between Cash Discount and Trade Discount

Accounting & Journal Entry for Preliminary Expenses

Stage – I – At the time of payment (Opening Entry)

Suppose company-A incurs a total of 100,000 as expenses before the start of business operations, the below entry will be used to show this.

| Preliminary Expenses A/C | 1,00,000 | Debit the increase in expenses |

| To Bank | 1,00,000 | Credit the decrease in assets |

(Paid via bank)

Stage – II – Preliminary Expenses Written Off (Indirect Expense)

Then company-A decides to write off the total amount of 100k in 5 years therefore only 1/5th (20,000) will be charged in this year’s income statement and remaining (80,000) will be shown in the balance sheet under the head Miscellaneous Expenditure.

| Preliminary Exp. Written Off A/C | 20,000 |

| To Preliminary Expenses A/C | 20,000 |

Stage III – Charging to Income Statement (Closing Entry)

Company-A then posts the related expense in the current period’s Profit and Loss Account.

The same entry is repeated for the next 4 years to fully amortize the charge in forthcoming accounting periods.

| Profit and Loss A/C | 20,000 |

| To Preliminary Expenses A/C | 20,000 |

They are not be confused with pre-commencement costs which are incurred immediately before the commencement of business, however, in this case, the business incorporation is already complete. Pre-commencement expenses are directly charged to the current period’s income statement. Example – Employee recruitment expenses, etc.

Short Quiz for Self-Evaluation

>Related Long Quiz for Practice Quiz 29 – Preliminary Expenses

>Read Deferred Revenue Expenditure