- Meaning

- Examples

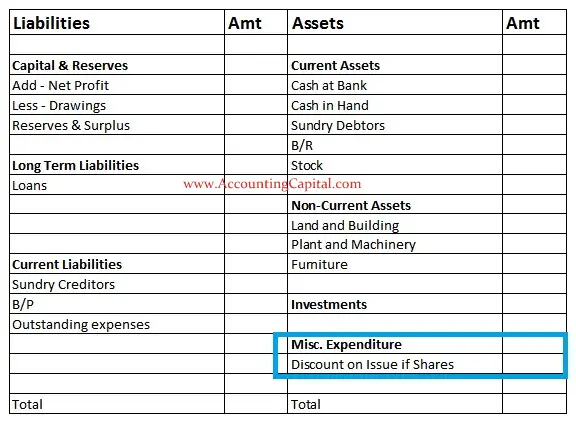

- Inside the Balance Sheet

- Is Goodwill a Fictitious Asset?

- Difference Between Fictitious Assets and Intangible Assets

- Quiz

- Revision Video

- Journal Entry

- Which Accounts are Fictitious Assets Transferred to?

- Conclusion

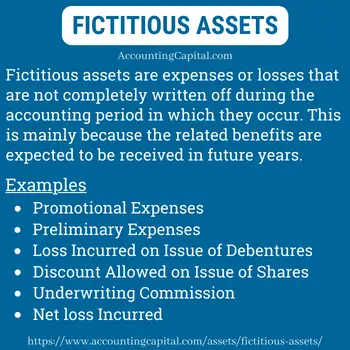

Meaning of Fictitious Assets

The best way to understand this is to memorize the meaning of the word “fictitious” which means “not true” or “fake”. Fictitious assets are expenses or losses which are not written off completely during the accounting period of their occurrence.

They are not assets at all, however, they are shown as assets in the financial statements only for the time being.

A straightforward example is that of a significant promotional expense. Suppose a small company decides to spend a large sum of 10 Million on marketing a new product and the benefit of such an expense is to last for 5 years.

In year 1, (1/5th) of the total money spent i.e. 2 Million will be shown in the income statement whereas the remaining (4/5th) 8 Million will be shown in the balance sheet as a fictitious asset (under the head Miscellaneous Expenditure).

Important Points

- They are written off against the firm’s earnings in more than one accounting period. Basically, they are amortized over a period of time.

- They are recorded as assets in financial statements only to be written off in the future.

- It is important to note that such assets do not exist physically or have any resale value.

- The portion of the expense that is kept for the future is a fictitious asset, while that which is written off in the current period is not.

Related Topic – Is Prepaid Expense a fictitious asset?

Reasons why some expenses are not expensed off entirely in the same year

- Benefit in the future period – If a business determines that the benefit of an expense or loss will be derived in a future accounting period, then splitting the cost accordingly is both logical and advisable.

- Incorrect financial numbers – A firm may not be able to justify its financial statements if they show the entire expense or loss in a single year. It may end up showing an unreasonably large net loss and this may affect the firm’s valuation of goodwill.

In Simple Terms – Fictitious assets are expenses/losses that are not completely written off during the accounting period in which they occur. There is no value in them, but they are still listed as assets in financial statements (temporarily). Why? – because the related benefits of these assets are expected to be received in the future; therefore, showing them as an expense today would do an injustice to the company’s financials.

Examples

- Promotional Expenses of a Business

The marketing expenditures of businesses are viewed as investments that are expected to produce long-term returns in future years. The value of these assets is periodically reduced through the process of amortization over a number of years.

- Preliminary Expenses

The term “preliminary expenses” refers to all costs incurred before the formation of a business. Examples of such expenses incurred before the incorporation of a business are legal costs, professional fees, stamp duty, printing fees,

- Discount Allowed on the Issue of Shares

An issue of shares at a discount occurs when a company issues its shares for a lower price than its face value. For example, if the face value of a share is 25 and the company issues it at 20, then 5 (25 – 20) is the discount provided by the company on the issue per share.

Now, if the company issues 90,000 such shares at a discount to different investors it would lead to a total loss of 90,000 x 5 = 450,000. Such a loss is treated as a miscellaneous expenditure (fictitious asset).

- Loss Incurred on Issue of Debentures

The premium payable on redemption of debentures issued at par or at a discount is a capital loss. For example, if a debenture is issued at a par value of 20, however, the redemption is at a premium i.e. 22 then the loss incurred per debenture is 2 (22 – 20).

Now, if the company issues 80,000 such debenture the total loss incurred at the time of redemption shall be 80,000 x 2 = 160,000. This loss should be appropriately reduced over time.

- Underwriting Commission

The underwriting commission is the compensation an underwriter receives from investors for placing a new issue. It is advisable to write off such a fee over time.

- Net Loss Incurred by a Company

In some cases, the debit balance of a profit and loss account is also treated as a fictitious asset.

Related Topic – List of Tangible and Intangible Assets

Shown in the Balance Sheet

They are shown in the balance sheet on the asset side under the head “Miscellaneous Expenditure”. (To the extent not written off or adjusted)

The above example is provided to demonstrate an expense which may not be treated as an expenditure in the current accounting period, hence it will be recorded as a fictitious asset on the balance sheet.

Why are they shown on the balance sheet?

The organisation will receive returns from these expenses over time, much like it does from other assets. This is the concept behind treating such miscellaneous expenditures as assets.

Depreciation is not possible since they are not tangible, therefore they are amortized as time goes on.

Related Topic – Can Depreciation be Charged on an Asset in the Year of Sale?

Is Goodwill a Fictitious Asset

Another way to ask this question is “Are intangible assets such as patents, copyrights, trademarks, etc. also fictitious assets?”.

In short, the answer is No, goodwill is not a fictitious asset and the same is true for other intangible assets.

Acquisitions involve two companies, one purchasing and one being acquired. Goodwill = Purchase price of the targeted/acquired company – (Fair market value of the total assets of the acquired company – Fair market value of the total liabilities of the acquired company)

Reason – An important characteristic of a fictitious asset is that it does not have a realizable value which means it can not be sold in the market to fetch money. However, it is not true for goodwill, patents, and copyrights, since they all have a monetary value and can be sold in the open market.

Related Topic – Can Goodwill be Negative?

Fictitious Assets Vs Intangible Assets

| Basis | Fictitious Assets | Intangible Assets |

|---|---|---|

| Value | They have no realizable value. It means they can not be sold in an open market. | They have a realizable value. It means they can be sold in an open market. |

| Use | They are assets only in the name and do not play a role in revenue generation. | By actively contributing to revenue generation, they add value to the process. |

| Extent | Such assets are very limited when it comes to their role and usage in a firm. | Such assets have a broad spectrum of roles and usage in a business. |

| Examples | Promotional expenses, Preliminary expenses, Loss on the issue of debentures, Loss on the issue of shares, Underwriting commission, etc. | Goodwill, Patents, Copyrights, Trademarks, Logos, Licenses, Broadcasting Rights, Customer Data, Franchises, etc. |

In addition to this, there is another frequently asked question: Are fictitious assets current assets?

The answer is that all intangible assets are not fictitious assets, however, all fictitious assets are definitely intangible in nature. In spite of this, it is important to note that they are not closely related.

Related Topic – Formula to Calculate Net Current Assets

Short Quiz for Self-Evaluation

Related Topic – What is a True-up Entry?

Revision & Highlights Short Video

Highly Recommended!!

Do not miss our 1-minute revision video. This will help you quickly revise and memorize the topic forever. Try it :)

Related Topic – What is Set off in Accounting?

Journal Entry

Depending on the type of expense, the journal entry may differ. Here, we will explain the entry in two steps:

- Journal entry at the time of payment of expense

| Fictitious Asset A/c | Debit |

| To Bank A/c | Credit |

At the time when an expense is paid and recognized in the financial statements.

- Journal entry at the time of reclassification entry of the expense as an asset

| Expense A/c | Debit |

| To Expense as Fictitious Asset A/c | Credit |

At the time when the expense is moved back to the income statement from time to time.

Related Topic – Journal Entry for Sale of Services on Credit

Fictitious Assets are to be Transferred to Which Account?

This is an accounting FAQ based on the concept of partnership accounting. They are to be transferred to the Partner’s Capital A/c.

As established in the article above that they are considered losses that are not transferred to the realisation account therefore they are transferred to Partner’s Capital account. This is because they are not real assets but are only shown in the financial statements for the time being.

Whenever possible, they are written off against the earnings of the firm. The transfer entry of fictitious assets, if any, is noted as follows:

| Partner’s Capital A/c | Debit |

| To Fictitious Asset A/c | Credit |

Related Topic – Journal Entry for Rent Paid in Advance

Conclusion

Fictitious assets is a common term frequently asked in accounting interviews. There is no actual asset associated with it, although it is treated as an asset in the accounting system.

Such treatment is based on the expectation that it will be beneficial to the business in the long run. This expectation may or may not go as planned and as time progresses, further modifications may be needed.

None of the accounting ratios is affected by these assets because of their false nature. They imitate assets except that they have no intrinsic value, they have no scrap value, and the ultimate goal is to write them off completely with the passing of time.

>Related Long Quiz for Practice Quiz 30 – Fictitious Assets

>Read Deferred Revenue Expenditure