-This question was submitted by a user and answered by a volunteer of our choice.

Introduction

In simple words, the term Sale of services means providing services to a customer in exchange for compensation. Various organizations offer services in various domains such as Education, Consultancy, Finance, Healthcare, Transportation, and many more.

A service is anything that provides value to the customer. It may be an experience, an advice, a solution, etc. Sometimes, services are also customized as per the specific requirements of the customer.

In the case of the sale of goods, the ownership of a tangible product is transferred to the purchaser. On the other hand, a service is an intangible offering and there is no transfer of ownership. The treatment of the sale of services is similar to the sale of goods in the books of accounts. Like goods, the sale of services may be by receipt of cash or on credit.

Journal Entry

Case1- Sale of service on credit

In this case, the service is provided on credit and the debtor would pay on a later date.

1. According to the Traditional rules of accounting:

| Debtors a/c | Debit | Debit the receiver |

| To Sales a/c | Credit | Credit all incomes and gains |

(Being services sold on credit)

2. According to the modern rules of accounting:

| Debtors a/c | Debit | Debit the increase in asset |

| To Sales a/c | Credit | Credit the increase in revenue |

(Being services sold on credit)

Case 2- Sale of Services on Cash

1. According to the Traditional rules of accounting:

| Cash a/c | Real Account | Debit what comes in |

| To Sales a/c | Nominal Account | Credit all incomes and gains |

(Being services sold on credit)

2. According to the modern rules of accounting:

| Cash a/c | Asset Account | Debit the increase in asset |

| To Sales a/c | Revenue Account | Credit the increase in revenue |

(Being services sold on credit)

Example of the Accounting Entry

Mr. K availed the financial services of XYZ Ltd. in May amounting to 20,000 with an agreement to pay the same in the following month. The journal entry in the books of XYZ for the month of May is as follows:

| Mr. K’s a/c | Debit | 20,000 |

| To Sales a/c | Credit | 20,000 |

(Being services sold on credit)

1. The first aspect of the entry is that Mr.K’s account is debited by 20,000. This is because Mr.K is a debtor of the company and a debtor is an asset for the company. As per the modern rules of accounting, an increase in assets is debited.

2. The second aspect of the entry is that the Sales account is credited by 20,000. This is because sales are revenue for the business and as per the modern rules of accounting, an increase in revenue is credited in the books of accounts.

Impact on Financial Statements

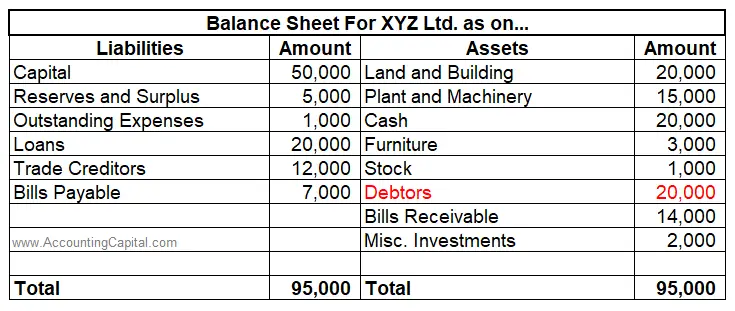

In the Balance sheet of the business, the debtor account would increase under the Assets head. A debtor is the current asset of the business. In case the payment is received in cash, the cash account will increase which is also a current asset of the business.

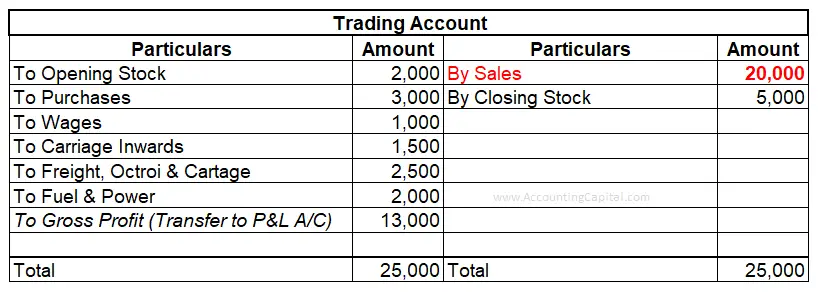

In the Trading Account of the business, the sale of services is credited. The impact of the above Journal entry on the Trading account of the business is shown below:

Conclusion

The key points from the above article are summarised as follows:

- Sale of services means providing services to a customer in exchange for compensation.

- Services may be of various types including education, financial advice, consultancy, healthcare, etc.

- The sale of services may either be on a cash or a credit basis.

- In some cases, services are also customized according to the needs of the customers.

- In the Trading account of the business, the sales are credited as it is revenue for the business.