-This question was submitted by a user and answered by a volunteer of our choice.

Meaning of Provision for Doubtful Debts

Almost every business entity has some debtors. Debtors are the entities that owe money to the business. In some cases, the debtors may or may not pay the money owed by them. To prevent loss in such a situation, Provision for Doubtful Debts is maintained.

It is usually provided on credit sales. As per the Prudence concept of accounting, a business must not anticipate future profits, but rather, prepare for all possible losses. Provision for doubtful debts helps the business prepare for future losses that may occur due to non-payment of dues by the debtor.

Generally, a percentage of the total amount owed by the debtors is kept aside as a Provision for doubtful debts. This amount may change from year to year. It is a proactive step taken to safeguard the firm’s financial position.

Journal Entry for Provision for Doubtful Debts

The Journal Entry for Provision for Doubtful debts is given below:

| Profit and Loss Account | Debit | Amt |

| To Provision for Doubtful Debt Account | Credit | Amt |

(Being Provision for Doubtful debts created)

An example of the Journal entry is given below:

ABC Ltd. has Sundry debtors amounting to 51,000. Out of these, 10,000 are written off as bad debts in the current year. Create a Provision for doubtful debts at 5%.

Solution:

The amount of Provision for Doubtful Debts is calculated below :

5% of (Sundry Debtors – Bad Debts)

= 5%*(51,000 – 10,000)

= 5%*41,000

= 2,050

Journal Entry:

| Profit and Loss Account | Debit | 2,050 |

| To Provision for Doubtful Debt Account | Credit | 2,050 |

(Being Provision for Doubtful debts created)

Treatment of Provision for Doubtful Debts in Balance Sheet

| Financial Statement | Calculation | Treatment |

| Balance Sheet | It is calculated on the following amount:

Sundry Debtors – Bad Debts |

It is deducted from Accounts Receivables/Sundry Debtors under the head Current Assets of the assets side of the Balance sheet. |

An example below shows the treatment in the Balance Sheet to understand this concept better.

Example

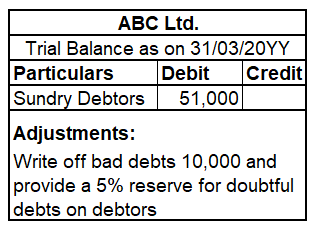

An extract of the Trial Balance of ABC Ltd. is given below:

Show the treatment of Provision for Doubtful Debts in the Balance Sheet of ABC Ltd.

Solution:

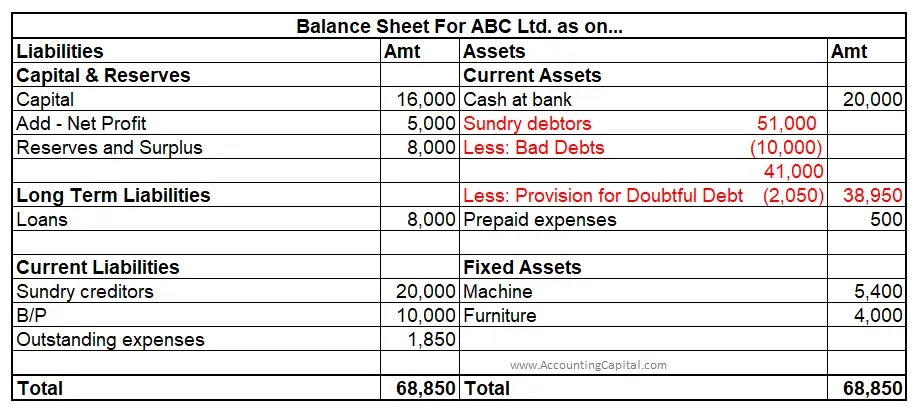

The Balance Sheet of ABC Ltd. after the above adjustment is given below:

Calculation of Provision for Doubtful Debts:

5% of (Sundry Debtors – Bad Debts)

= 5%*(51,000 – 10,000)

= 5%*41,000

= 2,050

Further, 2,050 is deducted from the total amount of sundry debtors. Debtors are shown on the assets side under the current assets head of the Balance Sheet of the business.

Conclusion

The above discussion may be summarised as follows:

- Debtors are a current asset of the business as they owe money to the business.

- A Provision for Doubtful debts must be created for any loss due to non-payment by the debtors.

- Generally, a percentage of the total amount of debtors is kept aside as a provision.

- The amount of provision for doubtful debts is deducted from the total debtors in the Balance sheet.

- Debtors are shown on the assets side under the current assets head of the Balance Sheet of the business.