-This question was submitted by a user and answered by a volunteer of our choice.

Introduction

There are certain accounts that are not closed at the end of an accounting year and their balances are carried forward to the next year. These may be Permanent accounts or Real accounts depending on the approach of accounting being followed. To understand the concept better, both Traditional and Modern approaches are explained below:

- Traditional Approach- According to the traditional accounting perspective, personal accounts (say- creditors, debtors, capital, etc) and real accounts (say- land, machinery, patents, etc) are not closed and their balances are carried forward for the next accounting period.

- Modern Approach– According to the modern accounting perspective, permanent accounts (say- Land, Machinery, Creditors, etc.) are not closed and their balances are brought forward to the next accounting year.

The purpose behind classifying accounts as Permanent and Temporary accounts is the process of closing the accounts at the end of the accounting period. Permanent accounts are not closed as they help in providing a consistent and continuous financial position of the business.

On the other hand, temporary accounts are closed at the end of the period and their balances are not carried forward to the next accounting period.

Permanent Accounts

Permanent accounts are those accounts that appear at the time of preparation of the Balance Sheet. These accounts are measured cumulatively and their balances never get closed until the organization is legally wound up. These accounts include asset accounts, capital account, and liabilities accounts.

Permanent or real accounts provide a historical perspective which is crucial in presenting the organization’s true financial position. These help in providing consistency in the financial reporting of the organization from one accounting period to the next

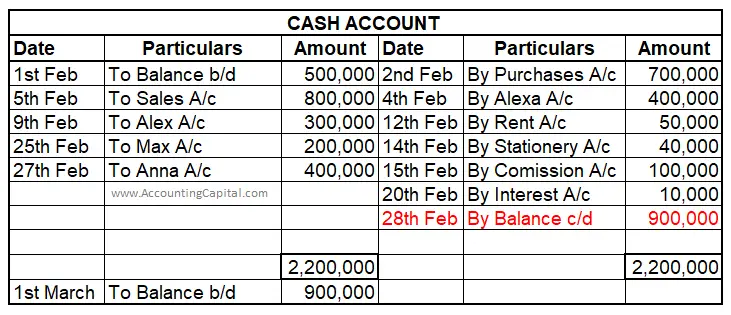

Example – As of 31st March, YYYY if ABC and Co. had Cash amounting to 500,000, then that amount will be carried forward (c/f) as the opening cash balance in the next accounting year. If the cash balance increased by 400,000 during the year, then at the end of the accounting year Cash balance would become 900,000. This amount will be again carried forward onto the next accounting period and the cycle keeps going on.

A snippet of the cash account given below will help to develop a better understanding of all personal and real accounts whose balances are carried forward to the next accounting period.

For an enhanced insight, accounts that get closed at the year-end are also explained below:

Accounts that get closed at the year-end

- Traditional Approach – According to the traditional accounting perspective, Nominal accounts (say- factory expenses, salary & wages, depreciation, discount received, interest received, etc.,) get closed at the end of the accounting year.

- Modern Approach – According to the modern accounting perspective, the temporary account gets closed at the end of the accounting period. They are closed so that the previous year’s income and expenses do not get mixed with the current year’s income and expenses. This would help the users of financial statements to know the true net profit.

Temporary Accounts

Temporary accounts are those accounts that appear at the time of preparation of the Income Statement (i.e., trading and profit & loss account). These accounts get settled by either debiting or crediting them yielding Gross profit/loss and Net profit/loss. The temporary account includes expense accounts, income accounts and withdrawals.

Example- Salary paid to the employees amounting to 200,000 for the previous year gets closed in the previous accounting period itself and their balances are not carried forward in the next accounting year as the Salary account is a temporary account.

Conclusion

On a concluding note, we may say the following:

- There are certain accounts that are not closed at the end of an accounting period.

- The balance at the end of the accounting period of such accounts is carried forward as opening balance for the next period.

- As per the Modern approach of accounting, permanent accounts are not closed and their balances are brought forward to the next accounting year.

- Permanent accounts include Accounts receivable, Accounts payable, Investments, Liabilities, and Capital account among others.

- As per the traditional accounting perspective, personal accounts and real accounts are not closed and their balances are carried forward for the next accounting period.

- Personal accounts include creditors, debtors, capital accounts, etc., and real accounts are Land, Plant and machinery, etc.

- Permanent or Real accounts help in providing a better perspective of the financial position to all the stakeholders of the organisation.