Closing Entries, With Examples

At the end of an accounting period when the books of accounts are at finalization stage, some special journal entries are required to be passed. In accounting terms, these journal entries are termed as closing entries. The main purpose of these closing entries is to bring the temporary journal account balances to zero for the next accounting period, which keeps the accounts reconciled.

As similar to all other journal entries, closing entries are posted in the general ledger. Once all closing entries have been passed, only the permanent balance sheet and income statement accounts will have balances that are not zeroed. Most common examples of these closing entries can be seen in temporary accounts like:

- Revenue account

- Dividend account

- Expense accounts viz., Wages, Office Expenses, Electricity, etc.

These accounts are be zeroed and their balance should be transferred to permanent accounts.

The permanent accounts in which balances are transferred depend upon the nature of business of the entity. For example, in the case of a company permanent accounts are retained earnings account, and in case of a firm or a sole proprietorship, owner’s capital account absorbs the balances of temporary accounts.

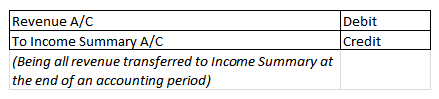

Closing Entry for Revenue Account

Total revenue of a firm at the end of an accounting period is transferred to the income summary account to ensure that the revenue account begins with zero balance in the following accounting period. The objective is to get the account balance to nil.

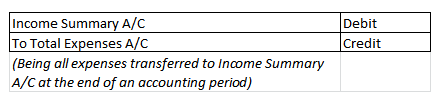

Closing Entry for Expense Account

Just like revenue, expense account is also closed at the end of an accounting period so that it can once again begin with nil balance. Below is the journal entry that will assist in this process:

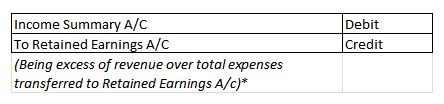

Closing Entry for Income Summary

After closing both income and revenue accounts, the income summary account is also closed. All generated revenue of a period is transferred to retained earnings so that it is stored there for business use whenever needed.

Let’s say if a business generates revenue of 1,000 in a particular accounting period and incurs expenses worth 950 the amount transferred in retained earnings would be 1,000 – 950 = 50.

*In case if expenses are more than revenue and business confront losses then the above-mentioned journal entry would be reversed.

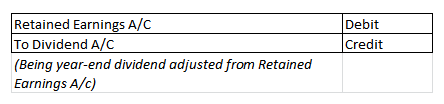

Closing Entry for Dividends (Capital Reduction)

This entry is required in case if a company pays dividends during an accounting period which results in a reduction of capital. Dividend (paid) account is then closed with the help of the below journal entry:

Closing entries help in the reconciliation of accounts which facilitates in controlling the overall financials of a firm.

Short Quiz for Self-Evaluation

>Read Difference between Reserves and Provisions