-This question was submitted by a user and answered by a volunteer of our choice.

When a sum of money is received by the company before providing the goods or services, it is known as an advance received from the customer.

It could be due to many reasons such as demand for security deposit by the landlord, payment security for purchasing goods in bulk, confirmation of the order, etc. It can also be referred to as Unearned Income or Deferred Revenue.

No, advance received from a customer is not treated as revenue. It is treated as a current liability, according to the accrual basis of accounting, because the amount is not yet earned. It is recorded on the liabilities side of the balance sheet until an invoice is sent to the customer.

After the customer is billed or invoiced, the advance received shown on the liabilities side of the balance sheet is removed and recorded as revenue. Once the revenue is earned, there will be a decrease in liability by that amount and an increase in the revenue.

Example

Mr K ordered cellphones in bulk from XYZ Ltd. and made an advance payment of 40,000 on the 5th of May. When the order was ready an invoice was sent to Mr K on the 5th of June of the same financial year. The journal entries in the books of XYZ Ltd. are as follows;

| 5 May | Cash a/c | Debit | 40,000 | Debit the increase in asset |

| To Mr. K’s advance a/c | Credit | 40,000 | Credit the increase in liability |

(being advance received from the customer)

| 5 June | Accounts Receivable a/c | Debit | 40,000 | Debit the increase in asset |

| To Revenue a/c | Credit | 40,000 | Credit the increase in revenue |

(being customer invoiced)

| 5 June | Mr K’s advance a/c | Debit | 40,000 | Debit the decrease in liability |

| To Accounts Receivable a/c | Credit | 40,000 | Credit the decrease in asset |

(being Mr K’s advance account cleared)

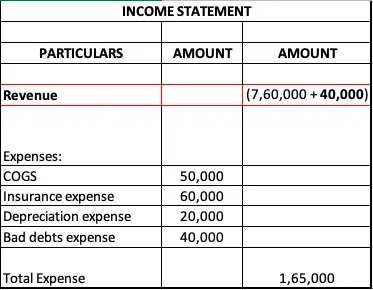

Placement in the Income Statement

(Extract of Income Statement)