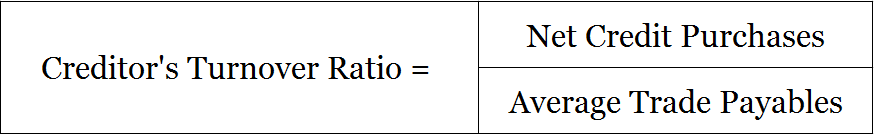

Creditor’s Turnover Ratio or Payables Turnover Ratio

Creditor’s turnover ratio is also known as Payables Turnover Ratio, Creditor’s Velocity and Trade Payables Ratio. It is an activity ratio that finds out the relationship between net credit purchases and average trade payables of a business.

It finds out how efficiently the assets are employed by a firm and indicates the average speed with which the payments are made to the trade creditors. The inverse of this ratio, when multiplied by 365, gives the average number of days a payable remains unpaid.

Formula to Calculate Creditor’s Turnover Ratio

Net Credit Purchases = Gross Credit Purchases – Purchase Return

Trade Payables = Creditors + Bills Payable

Average Trade Payables = (Opening Trade Payables + Closing Trade Payables)/2

Example – Payables Turnover Ratio

Ques. Calculate creditor’s turnover ratio from the information provided below;

Total Purchases – 5,00,000

Cash Purchases – 2,00,000

Creditors (Beginning of period) – 50,000 & Creditors (End of period) – 1,00,000

Ans.

Creditor’s turnover ratio or Accounts payable turnover ratio = (Net Credit Sales/Average Trade Receivables)

Net Credit Purchases = Total Purchases – Cash Purchases

= 5,00,000 – 2,00,000

Net Credit Purchases = 3,00,000

Average Trade Payables = (Opening Trade Payables + Closing Trade Payables)/2

= (50,000 + 1,00,000)/2

= 75,000

Ratio = (3,00,000/75,000) => 4/1 or 4:1

High and Low Creditor’s Turnover Ratio

A high ratio may indicate

• Low credit period available to the business or early payments made by the business.

• The company may operate majorly on the cash basis.

• The company is not availing full credit period.

A low ratio may indicate

• Creditors are not paid in time.

• Increased credit period is allowed to the business.

Short Quiz for Self-Evaluation

>Read Debtor’s Turnover Ratio