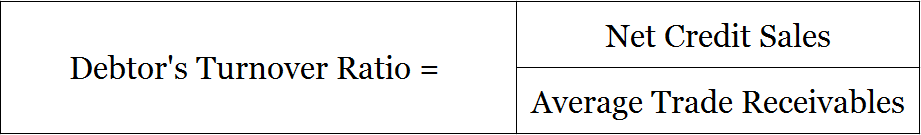

Debtor’s Turnover Ratio or Receivables Turnover Ratio

Debtor’s turnover ratio is also known as Receivables Turnover Ratio, Debtor’s Velocity and Trade Receivables Ratio. It is an activity ratio that finds out the relationship between net credit sales and average trade receivables of a business.

It helps in cash budgeting as cash flow from customers can be computed on the basis of total sales generated by a business. It is to be noted that provision for doubtful debts is not subtracted from trade receivables.

Formula to Calculate Debtor’s Turnover Ratio

Net Credit Sales = Gross Credit Sales – Sales Return

Trade Receivables = Debtors + Bills Receivable

Average Trade Receivables = (Opening Trade Receivables + Closing Trade Receivables)/2

Example – Receivables Turnover Ratio

Ques. Calculate debtor’s turnover ratio from the information provided below;

Total Sales – 5,00,000

Cash Sales – 2,00,000

Debtors (Beginning of period) – 50,000 & Debtors (End of period) – 1,00,000

Ans.

Debtor’s turnover ratio or Accounts receivable turnover ratio = (Net Credit Sales/Average Trade Receivables)

Net Credit Sales = Total Sales – Cash Sales

= 5,00,000 – 2,00,000

Net Credit Sales = 3,00,000

Average Trade Receivables = (Opening Trade Receivables + Closing Trade Receivables)/2

= (50,000 + 1,00,000)/2

= 75,000

Ratio = (3,00,000/75,000) => 4/1 or 4:1

High and Low Debtor’s Turnover Ratio

A high ratio may indicate

• Low collection period allowed to customers.

• The company may operate majorly on the cash basis.

• Company’s collection of accounts receivable is efficient.

• A high proportion of quality customers pay off their debt quickly.

• The company is conservative with regard to the extension of credit.

A low ratio may indicate

• High collection period allowed to customers.

• Good credit period availed by the company from its suppliers.

• The company may have a high amount of cash receivables for collection.

Short Quiz for Self-Evaluation

>Read Creditor’s Turnover Ratio